US cross-border truck traffic rises, but not like in 2014

William B. Cassidy, Senior Editor | Aug 25, 2015 6:30PM EDT

The number of trucks that passed through the five largest U.S. border crossings rose 5.6 percent from the first quarter to the second quarter of 2015, as the U.S. economy defrosted and expanded at a faster pace, according to U.S. Bureau of Transportation Statistics data.

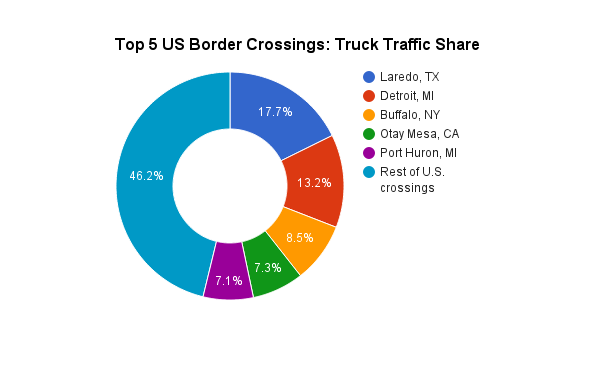

The five largest U.S. ports of entry for trucks — Laredo, Texas; Detroit; Buffalo, New York; Otay Mesa, California; and Port Huron, Michigan — accounted for 53.8 percent of total U.S. border crossings by truck in the second quarter, according to the BTS border crossing data.

The quarter-to-quarter increase, which followed an 0.6 percent sequential decline in the first quarter, reflects the moderate uptick in the U.S. economy as a whole, the strength of demand for Mexican produce in the U.S. this spring, as well as an increase in shipments of higher value manufacturing and consumer goods across the U.S. border.

Compared with the 2014 second quarter, however, truck crossings at the five largest ports of entry for tractor-trailers rose only 0.3 percent. In part, that reflects slower overall economic growth in the second quarter of 2015 compared with much stronger growth a year ago. In the first quarter, an easier year-over-year comparison made for a 2.4 percent annualized rise in truck crossings.

Year-over-year comparisons are likely to remain difficult in the third-quarter and second half. The U.S. economy expanded at a 4.6 percent and 5 percent clip in the second and third quarters of 2014, compared with a 2.3 percent rate in the second quarter this year.

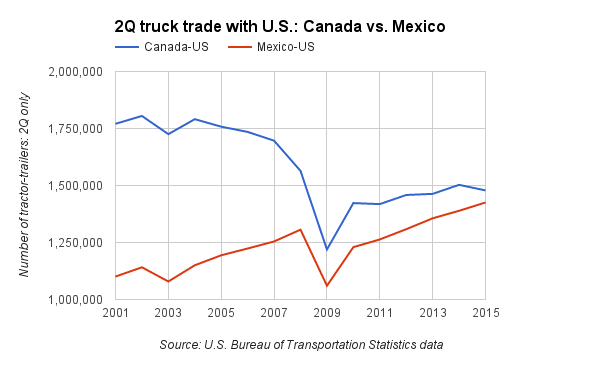

The BTS data tell a story of different borders, economies and trade relationships. Over the long-term, cross-border truck traffic with Mexico is climbing, while U.S.-Canadian truck crossings have declined. Since the second quarter of 2005, Mexican cross-border traffic has grown 19 percent, while trucks crossing the northern border dropped 16 percent. Truck crossings at both borders have increased since 2009, with Mexico approaching parity with Canada.

In this last quarter, Mexican border truck crossings were up 2.6 percent year-over-year, while crossings at the Canadian border dropped 1.6 percent from the same quarter a year ago. On a sequential quarterly basis, however, Canadian truck crossings increased 4.1 percent.

Canadian crossings jumped 5.1 percent in June from May, after dropping in April and May.

That increase may reflect a surge in exports to the U.S. sparked by the imbalance in value between the U.S. and Canadian dollars. “The whole movement of goods is changing,” John Kelly, president of Transplace Canada, said in an interview earlier this year. “You have to look at the dollar, look at fuels, look at exports.” A strong U.S. dollar and weak Canadian loonie will encourage exports to the U.S., though northbound shipments may be harder to find.

“As dollar drops and exports grow again, we will see an increase in southbound traffic,” Kelly said. In terms of the number of trucks crossing the border, the figures have proved him right.

Truck traffic through Laredo, Texas, the largest U.S. border crossing for trucks, rose 3.9 percent from the first quarter and 4 percent year over year, breaking past the 500,000 truck mark for the first time to reach 513,386 in the second quarter, according to the latest data from the BTS.

At Detroit, the second-largest U.S. truck border crossing, truck volumes increased 3.4 percent from the first quarter but dropped 4.6 percent year-over-year to 384,300 trucks. A similar pattern held at the Buffalo, New York, the third-largest U.S. port of entry for trucks, where traffic was up 7.6 percent from the first quarter but down 2.4 percent from a year ago at 246,007 trucks.

At Otay Mesa, California, the fourth-largest U.S. truck border crossing, truck traffic rose 10.3 percent from the first quarter and 2.1 percent from a year ago to 211,032 trucks.

Port Huron, Michigan, also gained traction. The port of entry’s truck traffic rose 7.6 percent from the first quarter and 2.3 percent from a year ago to 206,229 trucks in the second quarter. That 7.6 percent bump was the the port’s first consecutive quarterly rise in truck crossings in a year.

No comments:

Post a Comment