UPS Study Reveals Industrial Distributors’ Waning Customer Loyalty

Industrial buying dynamics study, evolution of the distributor value proposition, highlights the growth of direct-from-manufacturer purchasing, B2B e-commerce, and a Millennial workforce. By 24/7 Staff

July 09, 2015

Industrial distributors are facing changing market conditions that are challenging their long-standing business models, according to the UPS Industrial Buying Dynamics study, conducted by global research firm TNS.

The study revealed buyers are increasingly willing to purchase outside of their existing supply base, and identified four significant forces that are impacting how the relationships between industrial distributors and their customers are being redefined.

According to the UPS study, 38% of online industrial product buyers sourced products from a new supplier (vs. 34% in 2013) and 72% said they would shift spending to a distributor with a more user-friendly website.

“Customer loyalty today is built on a different foundation than the one distributors have built over generations,” said Brian Littlefield, UPS director of industrial manufacturing and distribution marketing. “Once price and quality standards are met, buyers are willing to explore vendors that better fit their needs, whether for a more convenient website, a better price, or simply someone who quickly answers product questions.”

The UPS study revealed four market forces impacting distributors and provides insights that can help them identify and address their strengths and weaknesses.

- Increasing buyer expectations require a more integrated and user-friendly purchase process

- Growth of Direct-from-Manufacturer purchasing and online marketplaces

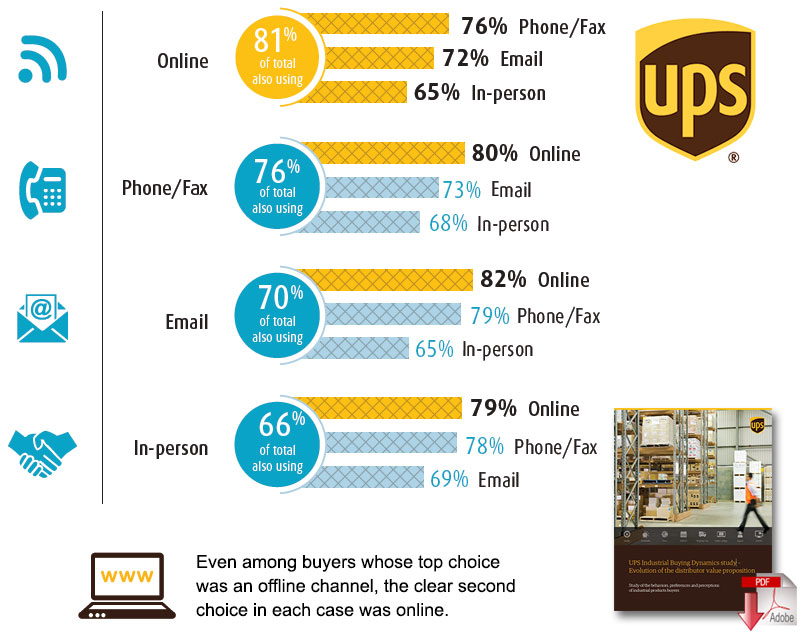

- The universal acceptance of, and demand for, B2B e-commerce

- Meeting the purchasing habits of Millennials as they become the next generation of purchasing leaders

How distributors can best respond to changing customer demands for product variety and knowledge, convenience and delivery speed, and competitive price varies by market niche. The study found, for example, that buyers are least satisfied in the areas of added-value services (25%) and physical locations (30%).

The UPS Industrial Buying Dynamics study of 1,500 purchasing professionals in February and March 2015 offers insights to key factors driving the decisions of those who buy or influence the purchase of industrial products.

The survey offers distributors a glimpse into their position in the marketplace and highlights potential areas for improvement and growth.

No comments:

Post a Comment