Managing Reverse Logistics to Improve Supply Chain Efficiency and Reduce Cost

Reverse logistics can represent a significant chunk of supply chain cost, and it’s typically not very well managed, it’s time to manage reverse as an integral part of supply chain management. By Brooks Bentz

July 09, 2015

Reverse logistics is like cleaning up the morning after a big party - a mess that no one really wants to face, resulting from things that are left over or ill-used from the day before.

The notion of reverse logistics isn’t new, of course.

The function has been around since the Phoenicians began shipping amphorae of wine to Rome in 1,500 BC.

The movement of product invariably results in the unintended consequences typically referred to as “over, short and damaged” (OS&D) along with the simple need to deal with unsold and returned items.

However, the opportunity to improve overall cost efficiencies has pushed companies to begin looking at the flip side of logistics as the “new frontier” in the continuous improvement of supply chain performance.

What was once mainly an afterthought now has a name. And in a growing number of cases, there’s now a clear mission: How do we manage reverse logistics as an integral part of supply chain management to improve efficiency and reduce cost?

Reverse logistics can represent a significant chunk of supply chain cost, and it’s typically not very well managed. Estimates range from 1 percent of overall supply chain costs (pretty well managed) to almost 10 percent (not very well managed).

If what follows raises questions in your mind, then you probably have more some work to do in terms of establishing an effective reverse logistics operation.

Foundation of the Challenge

There’s an inherent disorganization and messiness revolving around reverse logistics that makes it more challenging than conventional “forward” logistics management.

There’s an inherent disorganization and messiness revolving around reverse logistics that makes it more challenging than conventional “forward” logistics management.

During the head-haul or forward logistics business of getting product to market, the process is orderly: Items are packaged, labeled, and neatly loaded in cartons, on pallets, totes, or other appropriate containers, and into the appropriate vehicles for delivery to customers. They frequently move in large volumes of like-items that travel together until they reach their intended destination.

Transportation, as the last item in forward logistics, is generally the first step in what will become reverse logistics. With some exceptions, such as pick-pack-load, this is where the OS&D problems typically germinate. Some of the things that can and often happen in moving product through the pipeline include:

- Inaccurate counting during loading

- Misloading (wrong product, right truck, or right product, wrong truck)

- Improper or inaccurate paperwork

- Damage to product as it’s loaded or in transit

- Shrinkage/pilferage

- Delays or misroutes

- Mishandling at destination between the delivery vehicle, the back room, or store shelf

- Customer returns of damaged or unwanted product

Each step along the journey affords more opportunities to add to the misery because problems can arise at any point.

The reverse logistics process begins when one or more things occur at destination. When the transportation service provider arrives at the DC and the seal is broken, a new adventure begins.

During the unloading process, the DC team needs to be watchful and catch any number of possible problems, such as missing or damaged cartons, wrong product or quantities, styles, or sizes being incorrect.

The product may be late and needs to be expedited - or may even be so late that it’s refused. The product may also be damaged in handling coming off the truck, in the DC, or in the loading process for delivery. In other cases, it could be that a category manager or merchant buyer made the wrong bet and the product isn’t moving off the store shelf or the customer returns as unwanted, dysfunctional, or damaged.

A key part of managing reverse logistics effectively is installing processes as “preventive medicine” during the forward logistics stream. Let’s take a look at how several organizations deal with the challenges of reverse and where they see future opportunity for improvement.

3 Steps to Optimization

Wilson Lester, senior vice president of supply chain for Rite Aid and a veteran supply chain professional, believes that reverse logistics is a perfect opportunity “for retailers to optimize their supply chains.”

Wilson Lester, senior vice president of supply chain for Rite Aid and a veteran supply chain professional, believes that reverse logistics is a perfect opportunity “for retailers to optimize their supply chains.”

Lester and I recently spoke at length on the challenges and rigors of dealing with a large, complex network of thousands of active front-of-store SKUs, and he’s distilled the focus areas into the following three steps.

Forensics. For Lester, the first step is the critical “detective work” associated with learning what went wrong and why and turning those learnings into data and information for further analysis and improvement. The goal is to get to a root-cause analysis of why we have returns in the first place:

- Is there surplus driven by product purchases that exceeded consumer demand?

- Did the shelf life of the product expire before it was sold? How well did supply chain handle the fulfillment - was the product delivered for retail in a state of freshness that would exceed customer expectations?

- Was the supplier a contributor through poor packaging, late shipment, or incorrect orders?

Rite Aid collects substantial causal data through a number of channels in order to enhance the discovery process, with a goal of continuous improvement and reducing the overall commerce “waste stream.”

This causal information is then fed back to the manufacturers so they can improve packaging design, shipping systems, and processes, including things like pallet design, shrink-wrap procedures, outbound order management, carrier selection, and performance management. This information will also help manufacturers design their allowance and credit programs for their customers.

Recovery. Income recovery through merchandise credits or salvage can be a significant component of overall supply chain cost. The goal is optimizing profitability and income recovery by maximizing the value of these assets.

According to Lester, the steps vary, but include: re-packing; refreshing/refurbishing; sale to export marketers; return to supplier; and return to stock.

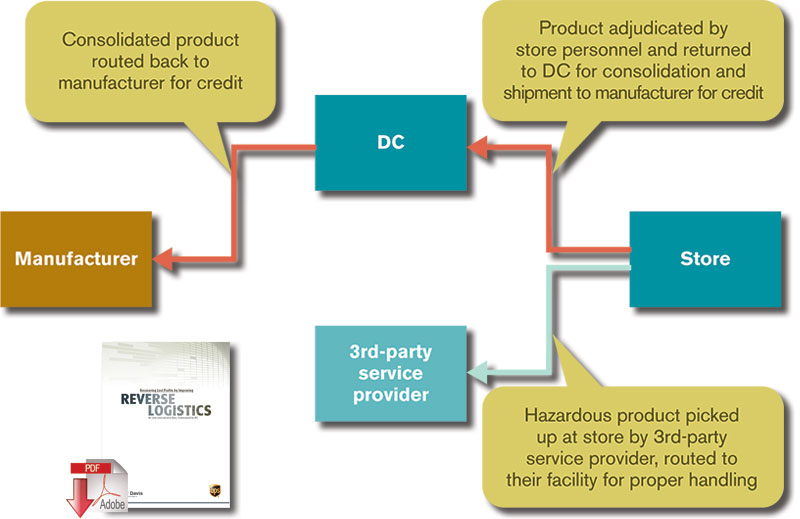

Other options include donation to charity or even destruction. Most commonly today, companies are using third-party service providers (3PLs) to partner with in their reverse logistics supply chain. These entities can offer flexible capacity, expertise in the regulatory environment, and the technology support to take on the complexity of handling multi-SKU reverse logistics. Rite Aid has a partnership arrangement with Inmar to assist in these areas as their 3PL.

Risk Mitigation. Lester’s third focus area is the mitigation of risk, with particular emphasis placed on expired or hazardous product. This has increased the complexity and rigor associated with unsold product; and, in turn, has made the education of field people in stores and DCs all the more critical in order to avoid violations that may lead to fines and damage to company reputation.

Sticking to the Rules

Lester points out that while education of the field organization is critical, so too is decision support technology. “This is because every manufacturer has its own terms, rules, and conditions for handling product,” he says.

Lester points out that while education of the field organization is critical, so too is decision support technology. “This is because every manufacturer has its own terms, rules, and conditions for handling product,” he says.

Let’s take chocolate candy as a mini-case study. In this example, a store receives an array of chocolates from four or five of the leading producers for Valentine’s Day. The Polar Vortex descends, snow and frigid temperatures keep romantic men at home frantically trying to “e-source” their goodies while in-store sales flag. The situation generates a glut of chocolates for the affected stores to now handle.

Each supplier’s terms and rules are different: One gives full credit for returns; one gives 50 percent; another gives no credit, but must inspect the unsold merchandise before it’s disposed of; and yet another gives no credit, but does not place any restrictions on its disposition. And yet this only represents a very small number of SKUs.

“It doesn’t take great imagination to grasp how complicated this gets across an entire store’s assortment,” says Lester. “The ability to scan an item and have the terms and rules displayed is a great step forward in enabling store personnel to ‘adjudicate’ the correct disposition - in particular with respect to hazardous items and expired product.”

Some retailers, such as Saks 5th Avenue and Nordstrom have a different strategy. Items that don’t sell in the mainstream stores are generally then moved to their second-tier chains (Off-5th and Nordstrom Rack) where they’re marked down to attract a different segment of the market.

The wine and spirits market is another segment with an equally demanding set of rules, according to Anthony Cerone, chairman of XTL, a Philadelphia-based 3PL specializing in alcohol warehousing and distribution.

“Because a high proportion of the price of alcohol is represented by state and federal taxes, there are rigorous rules on how to handle product that is damaged or destroyed in the supply chain process,” says Cerone.

Damaged cases must be inspected, and in some cases product can be recouped and repackaged or relabeled. Spirits are handled separately and are sent to a specific site in Kentucky for crushing and destruction. “These are critical steps in terms of the reclamation of taxes paid and duty drawback,” says Cerone.

Taking a Lesson from Dell and Sears

Bill Hutchinson is leading the supply chain transformation at Sears Holdings, which is the subject of this article: “Omni-Channel’s Impact on Logistics: Sears Customer Order Orchestration Layer”

Bill Hutchinson is leading the supply chain transformation at Sears Holdings, which is the subject of this article: “Omni-Channel’s Impact on Logistics: Sears Customer Order Orchestration Layer”

As senior vice president and chief supply chain officer, he’s tasked with a comprehensive overhaul of an American institution. With almost 2,000 stores, 46 DCs, 106 cross-dock facilities, and about $1.3 billion in annual transportation spending, it is a large, complex network handling over 600,000 SKUs.

Hutchinson brings a broad and deep background in supply chain management and came to Sears Holdings from Dell where he ran the global logistics and fulfillment organization and was responsible for reverse logistics and remanufacturing.

“Returned product was evaluated and determination was made on whether it could be resold as new, refurbished, or needed to be scrapped,” says Hutchinson. The goal, as with Rite Aid, was to maximize recovery. Where Rite Aid uses Inmar as a third party, Dell and Sears both use Genco in North America to handle the process.

According to Hutchinson, there’s an ongoing dance between the manufacturers and their go-to-market channel partners. This on-going negotiation seeks to determine rules of engagement - and exceptions to those rules - on how much product can be returned and under what circumstances.

They also include what a retailer may do with the product in an effort to protect the brand. In the case of Dell, Genco’s service centers run a diagnostic tool on returned product to assess condition and outline refurbishment requirements.

Dell runs a single return center in Tennessee, where all U.S. products go. These products are then cross-docked for ultimate return to the manufacturer - monitors, mice, and other peripherals - or remanufactured and sold on the Dell outlet website.

As of now, Sears Holdings has three return centers strategically located in the East, Southeast, and West. The Sears reverse logistics stream is now a multi-step process:

- Store level. Initial sort and segregation of items in accordance with returns terms and rules.

- Returns processing. Transportation to returns processor for evaluation, handling, aggregation, and return to vendor or for salvage.

- Delivery DCs. Large items (refrigerators, washers, dryers) go back to the delivery DCs for aggregation and further handling.

“Driving the work and work rules into the store is the biggest challenge,” Hutchinson says. “You have to inform and educate the store teams to optimize the initial ‘sort and seg’ routines so you don’t waste transportation dollars moving product back through the supply chain only to scrap it.”

Hutchinson also stresses that organizations need good metrics on recovery if they’re to have any chance of optimizing a disposition strategy. Deploying technology at the store level is essential, given the diversity of product assortment as well as the need to manage turnover in store help. “If you can more fully automate the routing of product and make better decisions at the point of return, you can vastly improve operationally,” adds Hutchinson.

Omni-channel fulfillment is also pushing more complexity into traditional supply chains and adding new steps and procedures at the store level. People can now buy on-line and both pick up and return product at the store.

With a goal of enhancing the customer experience and improving convenience, Sears is now experimenting with curbside fulfillment, where people can drive to an assigned parking spot and store personnel will come to their vehicle to process their return or deliver product bought on-line.

“You want convenience, but you’ve got to be smart about how you do it,” says Hutchinson. “Better tools at point of sale are critical to optimizing customer experience and maximizing the recovery rate for the company.”

The bottom line: Leading-edge companies, and those aspiring to be leading-edge, need to understand that getting reverse logistics right is as vital to overall performance and profitability as forward logistics - and that true end-to-end supply chain management is the key to long-term success.

No comments:

Post a Comment