Climbing the Reverse Logistics Mountain

In the past, reverse logistics was an unknown concept, and then considered a necessary evil. Now, OEMs have the potential to build a value chain that includes products at the end of their lives.

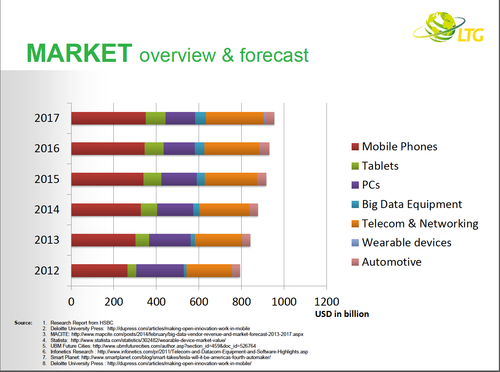

In 2015, combined global spending on mobile devices and data center equipment reached $600 billion. Telecom equipment spending, meanwhile, will hit $247 billion in 2015, according to Infonetics Research. At the same time, other electronic product sectors, including smart devices and smart home appliances, are emerging to grow from a $51.5 billion global market in 2014 to $89.1 billion in 2017.

In short, the world market is being flooded with electronic equipment that will one day reach its end of life. OEMs, then, need to look at ways to recycle, refurbish, and reuse these products and the associated components.

"There's a snowball effect," said Linda Li, chief strategy officer at the Li Tong Group, a reverse logistics service provider. "The explosion of devices represents billions of products around the world. We've found that the average OEM spends 8% of revenue managing reverse supply chain functions."

To be effective, though, OEMs need to be looking at how to move reverse logistics from cost to value. "There's been a surge in high-value obsolete products, components, and semi-finished goods," said Li, adding that 80% of mobile devices have components in them that can be reused at the end of life.

Finding the greatest value from the reverse supply chain often demands working with a reverse logistics provider. These organizations offer engineering expertise that allows them to extract the most value from products by deciding whether to refurbish or scrap devices. In addition, by working with many customers, these organizations can leverage operational scale to maximize return. "It's very costly for an individual company to develop a standard operating procedure, services, and platforms for reverse logistics," said Li. "We run an operation that is big enough that the fixed cost and overhead are absorbed."

In addition to partnering with a reverse logistics provider, OEMs need to look carefully at product designs to ensure that value is maximized at the end of the product at the end of its life. "Top tier OEMs are becoming more and more motivated to get a better understanding of how they can design future products to that more value can be recovered or salvaged from it at the end of the day," said Li. "There's also an effort to create less environmental impact."

In 2015, combined global spending on mobile devices and data center equipment reached $600 billion. Telecom equipment spending, meanwhile, will hit $247 billion in 2015, according to Infonetics Research. At the same time, other electronic product sectors, including smart devices and smart home appliances, are emerging to grow from a $51.5 billion global market in 2014 to $89.1 billion in 2017.

In short, the world market is being flooded with electronic equipment that will one day reach its end of life. OEMs, then, need to look at ways to recycle, refurbish, and reuse these products and the associated components.

"There's a snowball effect," said Linda Li, chief strategy officer at the Li Tong Group, a reverse logistics service provider. "The explosion of devices represents billions of products around the world. We've found that the average OEM spends 8% of revenue managing reverse supply chain functions."

Further, regulatory concerns, including Health Insurance Portability and Accountability Act (HIPAA), Fair and Accurate Credit Transactions Act (FACTA), Gramm-Leach-Bliley Act (GLBA) and Sarbanes–Oxley (SOX), are also on the rise. "Government and regulatory bodies are coming up with more and more strict laws and regulations on producer responsibility so there's a big demand for post consumer take back and recycling," said Li. Meanwhile, end users have data security concerns that raise their awareness of how end-of-life goods are being handled.

At the same time, OEMs are realizing the potential of aftermarket services, including parts service, warranties, and product insurance. These demand that OEMs develop a clear process for handling returned products. "Now, the forward supply chain and the reverse supply chain are intertwined," said Li.To be effective, though, OEMs need to be looking at how to move reverse logistics from cost to value. "There's been a surge in high-value obsolete products, components, and semi-finished goods," said Li, adding that 80% of mobile devices have components in them that can be reused at the end of life.

Finding the greatest value from the reverse supply chain often demands working with a reverse logistics provider. These organizations offer engineering expertise that allows them to extract the most value from products by deciding whether to refurbish or scrap devices. In addition, by working with many customers, these organizations can leverage operational scale to maximize return. "It's very costly for an individual company to develop a standard operating procedure, services, and platforms for reverse logistics," said Li. "We run an operation that is big enough that the fixed cost and overhead are absorbed."

In addition to partnering with a reverse logistics provider, OEMs need to look carefully at product designs to ensure that value is maximized at the end of the product at the end of its life. "Top tier OEMs are becoming more and more motivated to get a better understanding of how they can design future products to that more value can be recovered or salvaged from it at the end of the day," said Li. "There's also an effort to create less environmental impact."

No comments:

Post a Comment