The Multidimensional Nature of Sales & Operations Planning

A mature S&OP process aligns the supply chain with corporate strategy to become the glue that binds performance end-to-end across the supply chain. By Christopher Russell

1

June 19, 2015

Predictable financials are as much, if not more, important today as they were 25 years ago.

Today’s sales and operations planning (S&OP) process encompasses people, process and technology to create a business plan that will deliver the predictable financials executives seek.

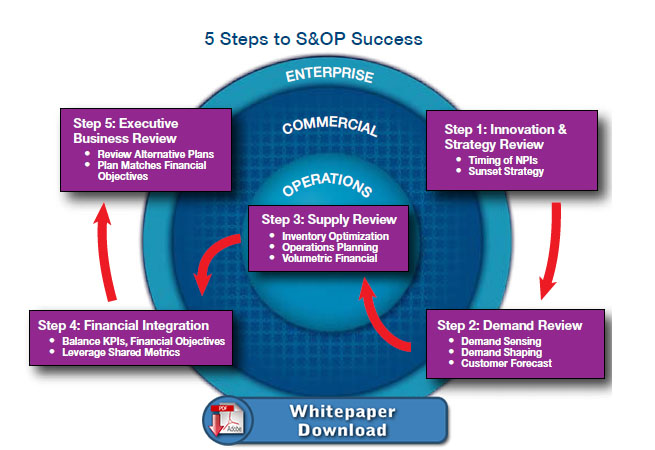

It is more than delivering an accurate view of the future, S&OP is about creating a repeatable process that can stand the elements of time, become the heartbeat of the organization, and bring demand, supply and finance together around a single plan that aligns with the corporate goals.

Ultimately the S&OP plan provides management a view at any point in time of how the company’s operations are performing vis-à-vis the financial plan. In this way it provides management guidance in the context of the end-to-end supply chain and prevents local optimization that can de-optimize the overall corporate plan.

A mature S&OP process aligns the supply chain with corporate strategy to become the glue that binds performance end-to-end across the supply chain. Once a repeatable process is in place and producing a well-balanced plan the company is able to turn its focus towards seeking new opportunities and removing barriers.

Advice from the pros:

Give Portfolio Review prominence in the S&OP process, as often the success of S&OP hinges its effectiveness. Employ advanced techniques such as attribute-based planning, which allows a company to accurately forecast new products even when no direct prior sales history exists.

Give Portfolio Review prominence in the S&OP process, as often the success of S&OP hinges its effectiveness. Employ advanced techniques such as attribute-based planning, which allows a company to accurately forecast new products even when no direct prior sales history exists.

Technology enablers: Logility’s supply chain optimization solutions provide customizable views to review plans for new product introductions (validate sales projections, expected launch dates, consumption forecasts, pipeline fill), and for products that are phasing out (manage the depletion of inventory, transition to new products). Leverage Logility’s cluster and Lifecycle Planning functionality to develop forecast profiles based on aggregate new product launch history.

More than Balancing Supply and Demand

Many years ago APICS professionals defined S&OP in an attempt to create a standard, process-based solution to business planning within the supply chain. The goal was to develop a framework that would outline interactions as the business plan was executed throughout the organization.

We’ve been working for years to break the walls between functions in the supply chain. For example, we often hear S&OP referred to as a balancing act between supply and demand. At its most basic form, this is correct. How do we get the supply side and the demand side of our business to agree on one plan, one set of numbers and one set of actions? In the old days we just wanted ‘sales’ and ‘operations’ to talk to each other and stop competing. Now we want much more; we want them to collaborate!

The same thing is happening today except there are many more dimensions to the balance than just supply and demand. The modern S&OP challenge is how to balance, negotiate and manage across the multiple dimensions of the supply chain.

Today the ‘demand’ side of the equation is no longer a homogenous single sales organization or channel. It is a multi-channel, multi-layered amalgam of demand signals that has to be synthesized into operations. The supply side is now a multilayered, global supply chain with third party suppliers, manufactures and providers. Each of these layers not only provides products, they consume and contribute a complex matrix of products, expertise, services, and information that needs to be synthesized into the organization.

The supply chain today extends out beyond the corporate walls into collaboration with different partners, suppliers and customers. This is more than simply passing data back and forth, this is truly collaborating in an effort to control, move and orchestrate the extended supply chain ecosystem.

Step 1 - Innovation and Strategy Review

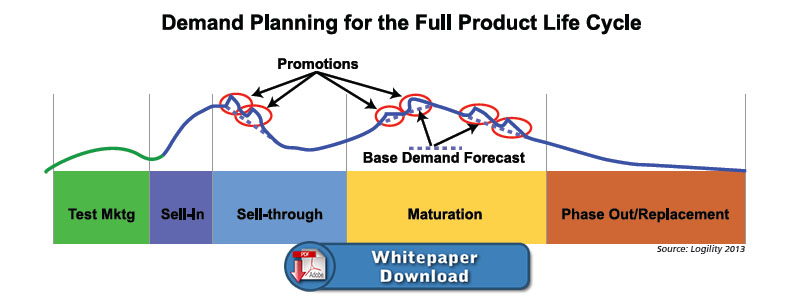

An important consideration for any company is managing product lifecycles.

- What products should we introduce to the market place?

- When should we introduce them?

- What products should we sunset or discontinue?

These are all critical questions to answer and the impact on sales, production, inventory, and finance must be understood.

Introducing new products is a key aspect of the innovation and strategy review. NPIs can significantly impact the well being of a company including inventory and lost sales. The ability to predict sales on NPIs, where there is no sales history to model, can be difficult. Traditional time-series forecasting tools that utilize history will not work effectively for NPIs. To overcome these challenges, more advanced techniques must be employed.

Companies that have been successful in managing NPIs utilize advanced techniques such as attribute-based forecasting which generates demand profiles for new products based on existing product demand tied to identifiable attributes such as style, color, season, material type, etc. A well-designed attribute-based forecasting system will continually monitor demand signals, quickly recognize any deviation from the forecast, and adjust the assumptions and forecast to match the actual demand signals.

Modern supply chains balance these complexities of supply and demand across multiple horizons at multiple levels of aggregation. They manage tradeoffs internally between procurement, manufacturing, brand management, engineering, finance, and IT.

The modern supply chain is full of constant change with constant product innovation. This means that even if you determine the tradeoffs today, it will all change tomorrow - the pace of change has quickened considerably. What used to be a monthly cycle is now turning weekly, daily and in some cases instantly as transactions are harvested to provide guidance to the operational plan.

This is not your father’s S&OP. This multidimensional swarm of supply and demand is a slippery fish to grab hold of. The challenge, though, is the same. How do we get all the players to work together and agree on a business plan?

I suggest that at some level the complexity itself is a smokescreen. If we as supply chain professionals plan appropriately, the plans we create should become the plans we execute and when we roll them up at the end of the period they should add up.

No comments:

Post a Comment