Omni-Channel’s Impact on Logistics: Sears Customer Order Orchestration Layer

While major Big Box retailers have struggled to keep pace with consumer-driven demands for instant gratification, Sears Holdings has come up with new innovations to anticipate and serve shoppers with a new one-day ground delivery service supported by a dynamic DC network. By Patrick Burnson

July 09, 2015

For generations of Americans, Sears has been an iconic symbol of product reliability and customer service.

But huge disruptive forces in information technology and buying habits have put the retailer back on its heels over the last few years.

Faced with unforeseen challenges posed by online shopping and same-day delivery demands, Sears needed a makeover - and it needed it fast.

According to analysts at The Stevenson Company, a market research firm that’s been following the retailer, Sears Holdings had lost considerable market share of home appliance sales - a key part of its business model - to Lowe’s and Home Depot, while watching its total revenue continue to decline.

Sears Holdings is a retailer with approximately 1,980 full-line and specialty retail stores in the U.S. operating through Kmart and Sears and 449 full-line and specialty retail stores in Canada operating through Sears Canada, Inc., a 51 percent owned subsidiary.

But the value of this massive brick-and-mortar network has been brought into question by even the most bullish of business leaders.

More importantly, however, executive leadership within the Sears Holdings family itself became urgently aware that change management was not a choice, but an imperative.

Having clearly recognized the significant shifts on the retail landscape, Sears set to work last year in launching an omni-channel fulfillment strategy designed to stem the bleeding and rebuild its storied brand.

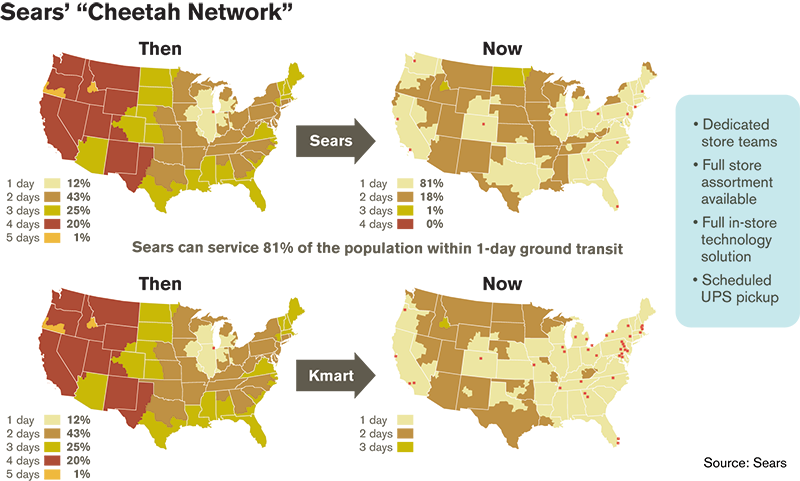

This initiative comprises a new, one-day ground delivery service called “Sears cheetah” and “Kmart cheetah” that works in conjunction with “roadrunner,” the store-facing DC network that can expand dynamically to keep pace with local customer demand and support on-line customer fulfillment. The move, says analysts, puts Sears in a position to keep pace with new customer expectations.

Recognizing Nascent Trends

Investment analysts agree that omni-channel retailing may play a significant role in reviving profitability for Sears as it begins to shrink its store base while boosting sales online and through its shopper-loyalty program.

Investment analysts agree that omni-channel retailing may play a significant role in reviving profitability for Sears as it begins to shrink its store base while boosting sales online and through its shopper-loyalty program.

Sears’ executives say it may also raise money by selling and leasing back as many as 300 stores.

“Managing retail today is fundamentally different than it was just three years ago,” observes Bill Hutchison, chief supply chain officer and senior vice president for Sears Holdings, noting that self-contained markets are confronted with competition from unexpected players.

Supply chain visibility, mobile solutions, Big Data, and predictive analytics make up what Hutchison describes as “nascent considerations” these days. “It’s an omni-channel world after all,” he says, observing that half of all Sears purchases have been influenced online.

Hutchison came to Sears Holdings just last April, having served as vice president of global fulfillment and logistics for Dell, Inc. He spent seven years with the computer maker in logistics roles of increasing responsibility. Today, he’s responsible for all aspects of Sears Holdings’ supply chain, including distribution, transportation, customs compliance, and global sourcing.

“The great majority of our customers shop online before coming into our stores,” Hutchison says. “The same number, 80 percent, rely on their social networks when researching new products, and 70 percent use their smartphones for shopping in the store. Another ‘nascent’ trend is that most shoppers would prefer to use their phones rather than simply asking a store employee for information.”

And who can blame them? After all, shoppers literally have the entire mall in their hands, says Hutchinson. They now use finger or keystrokes rather than footsteps and get better product information on demand through social networking. Furthermore, this represents a storefront multiplier for Sears.

“Shoppers pick a store based on experience, price, services, assortment, and location,” says Hutchinson. “The ‘final mile’ of delivery is key.”

Playing to its Strengths

Sears Holdings’ launch of its omni-channel fulfillment strategy was designed around the customer. Market research indicated that today’s shoppers want fulfillment on their terms, so it was imperative for Sears to be more agile.

Sears Holdings’ launch of its omni-channel fulfillment strategy was designed around the customer. Market research indicated that today’s shoppers want fulfillment on their terms, so it was imperative for Sears to be more agile.

“When we first recognized this challenge, we only had two DCs near Chicago to meet these new customer experience expectations,” says Hutchinson. “That’s when we decided to open up our entire network of stores and to unlock the supply chain for shipping any available product.”

Hutchinson admits that the “Amazon Factor” represented a force that unleashed this strategy. “E-tail competitors have a low barrier to entry, and can move very quickly to reset customer expectations and fulfillment requirements.” However, he adds that traditional retailers have a natural advantage with the proximity of their store base if they’re utilized as another node in the supply chain.

With this infrastructure in place, Sears countered by installing a paperless picking system in all its stores and worked with UPS to systemically select optimal store fulfillment locations. If one Sears store did not have a specific product for immediate delivery, the system can now pull from another store’s inventory to ensure consistent service. “All of this had to be done so that it was invisible to the customer. It had to appear seamless and simple,” says Hutchinson.

Of course, it was anything but simple. “One of the big hurdles we faced was getting our people across all disciplines trained and measured by a new set of weekly metrics,” says Hutchinson. “This brought into play a whole dimension of accountability.”

“A robust change management was instituted for our roadrunner DCs as well,” says Jeff Starecheski, vice president of logistics services for Sears. Starecheski has been with Sears since 1997, and has climbed the career ladder to manage a diverse range of duties in that time. Today, he is responsible for supply chain strategy, business integration, planning, solutions marketing, and reverse logistics.

So far, says Starecheski, his team has been able to support dynamic growth, with minimal capital investment. “Given the urgency of addressing fulfillment concerns, we put roadrunner high on our radar screen. If the customer wanted it shipped that day, or would prefer to pick it up in one of our parking lots, the service had to be flawless.”

The trial by fire, say both executives, came this past holiday season when Sears satisfied shoppers on both ends of the supply chain loop. According to StellaService, a company that measures and rates customer service performance for online retailers in a process audited by auditing firm KPMG, Sears was able to offer a Monday, pre-Christmas order cutoff for online purchases. “It’s all about leverage,” says Starecheski. “With our dominant position in appliances and other ‘white goods’ delivery, we can utilize our 106 cross-docking facilities to move any Sears product on demand.”

Flexible Network

Sears Holdings’ omni-channel network also flexed up by 60 percent and improved velocity for the holiday peak by adding store nodes across the country.

Sears Holdings’ omni-channel network also flexed up by 60 percent and improved velocity for the holiday peak by adding store nodes across the country.

“We can now ramp that up or down depending on the seasonal volume,” explains Hutchinson. “Our technology-based platform drives optimization the way store associates pick, pack, and ship products. Our standardization drives productivity.”

To that end, Sears Holdings implemented a “pilot, test, and learn” mission across its entire network. Today, stores can be added dynamically, as seasonal needs intensify from Black Friday to Cyber Monday through the Christmas season. Furthermore, the retailer can add proximity to further reduce cycle time for delivery.

“As we designed the network, we found a tipping point to balance with store-facing DCs that we can turn on during this program,” says Hutchison. “This gives us coverage that is appropriate relative to the customer mix across the U.S.”

He also notes that 90 percent of global trade still goes through some type of traditional retail outlet. For Sears Holdings, the key is “to lean into and embrace that footprint,” thereby enabling tailored solutions to meet customer needs.

He also notes that 90 percent of global trade still goes through some type of traditional retail outlet. For Sears Holdings, the key is “to lean into and embrace that footprint,” thereby enabling tailored solutions to meet customer needs.

Team Alignment

None of this would be possible, says Starecheski, without the complete buy-in of Sears Holdings personnel at every level. Omni-channel fulfillment, he says, involves everyone across the organization.

None of this would be possible, says Starecheski, without the complete buy-in of Sears Holdings personnel at every level. Omni-channel fulfillment, he says, involves everyone across the organization.

“One of the critical factors is the establishment of cross-functional teams with the appropriate levels of incentive and accountability, leveraging not just supply chain team, but the store operations team, on-line business unit, as well resources in marketing, merchandising and IT.”

This is especially true when it comes to implementing the Cheetah network, which can service 81 percent of the U.S. population with 1-day ground service. It’s composed of dedicated store teams working with full-store assortments and scheduled UPS pick-ups.

“With the alignment of responsibilities comes the alignment of incentives,” says Starecheski. “If one Cheetah store can’t measure up to our shared mission, we can easily find another store that can. Our focus to drive accurate promises to our customers should be relentless.”

Keeping faith with Sears and Kmart shoppers has led Starecheski to coin the acronym “COOL” for Customer Order Orchestration Layer. He says it will be essential for omni-channel fulfillment in the future.

“With ‘COOL,’ we can manage fulfillment promises at the customer level and optimize the fulfillment location of every order for speed or cost, whether from a store of a DC,” says Starecheski. “We can save every sale…and prevent customers from abandoning the cart or going to a competitor’s site. Ultimately we’re reducing the chain safety stock and improving product availability for our customers.”

Customer expectations are evolving to reflect the 24/7 digital world, adds Starecheski. He says that this requires what he refers to as an “always on network” that will enable Sears to ship every day of the week, mirroring shoppers buying routines. “We are not there yet,” he says, “but our goal is to have friction-free transactions that engage shoppers.”

No comments:

Post a Comment