An approach to evaluate and manage supply chain risk

Friends of ours were over for dinner last night and the matron is doing some sort of business education upgrade to prepare for the future.

Her research topic is supply-chain management within her firm, so I sent her this fromDavid Acheson and Jennifer McEntire of The Acheson Group (TAG):

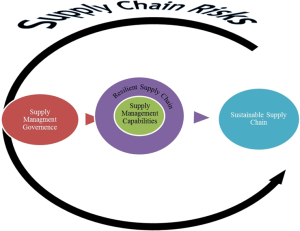

In today’s food and beverage industry, everyone has a supply chain that they rely on. And with that comes risk. You may be staking your brand reputation on the quality and safety of products or ingredients you are sourcing from somewhere that is not under your direct control. In short, you are relying on someone else to do things right, and inheriting risk if they don’t. Congress recognized that sometimes you rely on suppliers to control risk, which puts supplier management into the bucket of a “preventive control” and thus part of the Food Safety Modernization Act

In today’s food and beverage industry, everyone has a supply chain that they rely on. And with that comes risk. You may be staking your brand reputation on the quality and safety of products or ingredients you are sourcing from somewhere that is not under your direct control. In short, you are relying on someone else to do things right, and inheriting risk if they don’t. Congress recognized that sometimes you rely on suppliers to control risk, which puts supplier management into the bucket of a “preventive control” and thus part of the Food Safety Modernization Act

But the road doesn’t end at regulatory compliance. Food professionals often worry about their supply chain, so much that it provokes many sleepless nights for executive leaders. Why? Because no matter how many suppliers you have, their operations are not under your direct control. Again, you rely on a third party to make regulatory and ethical decisions in relation to your product, and ultimately, your brand. You rely on them to do the right thing. And let’s face it—sometimes people just don’t. That’s why The Acheson Group (TAG) has developed an approach that goes beyond a “one size fits all” practice of asking for a certificate of analysis (COA) and an audit report. With those two boxes checked we feel good about our suppliers and can relax – right? Wrong!

Clearly the extent of the risk to you from your supply chain is dependent on many factors, some of which directly relate to what you do with the ingredients or products once received. For example, if you are making a cooked product, then you worry less about microbiological contaminants in your externally sourced ingredients being used in your cooked product. However, depending upon the region from which they are sourced, you may need to be concerned about heavy metals in those same ingredients since the cooking step will do nothing to mitigate the risks from heavy metals or other chemical contaminants.

One is often faced with the question of how to manage complex supply chains in a way that does not break the bank. Like most things related to food safety, the logical approach to controlling the supply chain is a risk-based approach. In simple terms, this means asking yourself, “Which of my suppliers are ones that I consider to be high risk?” Many in the food world do this type of mental exercise on a regular basis, but typically it is somewhat ad hoc, based on instinct, the result of a group brainstorm, and not fact-based, objective or consistent. The reliance on “gut feel” doesn’t generally cut it when trying to secure the resources to manage that risk. And it’s not going to satisfy FDA either, which proposes that the evaluation of supplier risk (assessed through regulatory compliance, your history with them, and other factors) be documented when suppliers are controlling hazards – whether through the Preventive Controls rule or as part of Foreign Supplier Verification.

As you think about how to balance your resources with your risk, it becomes evident that the need for metrics to quantify supply chain risk is an effective approach. One of the tactics we have taken at TAG is to incorporate this mindset through a logical extension of these challenges and develop an approach that analyzes supply chain risk from two dimensions. The first dimension is to determine the inherent risk of the product or the ingredient. Clearly some products have more inherent risk than others. For example, leafy greens are generally considered to be a higher risk than a dry powder. As a result, our approach has been to develop a series of questions, the answers to which each carry a score that then allows you to quantify the inherent risk of a given product or ingredient. By going through this process with all the products you use, it is possible to then rank the products numerically by risk.

The second dimension to this process is to follow the same steps for each supplier. Referring to the earlier example, a leafy green supplier may have implemented robust good agricultural practices and be ahead of the game in relation to on-farm risk control. Another supplier of leafy greens may be adequate, but have a few areas in which there is opportunity for improvement. In this situation, while the inherent product risk is the same for the leafy greens product itself, the actions and controls put in place by different suppliers will lead to differing risks and consequences for the same product. By again asking a series of customizable questions and placing scores on each answer, you can then rank supplier risk over a wide range of variables. Much like the product-risk scoring explained earlier, you can then rank the suppliers numerically by risk.

The next part of this process is to match the product with the supplier by comparing the two ranked lists (product ranking and supplier ranking). By going through this process, it is possible to identify the high-risk products with the high-risk suppliers, thus identifying your greatest supply chain vulnerabilities.

This process will allow the application of objective, standardized, and consistent metrics to supply chain risk and rank product-supplier combinations in terms of high to low risk. But, that is only the first step! Because critical questions have been assigned to both the product and the supplier, it is then appropriate to look at which questions drove the score high and thus develop a risk management strategy that is focused on fixing and mitigating the problem. For example, if a supplier is scoring high due to the lack of a robust environmental control program or allergen control program, you can address that deficiency specifically with the supplier and thus reduce your risks. This tool allows you to capture not only the identity of the risk, but how to apply resources to eliminate the risk.

Despite all the benefits listed above, the overall value of this approach is to allow your firm to have a tangible, objective method to leverage metrics in driving the decision-making process. It will allow your company to defend why resources need to be directed to certain areas of supply chain risk control. Another advantage of this approach is that it is possible over time to monitor improvement in risks through the overall reduction in scores. However, even as overall risk scores drop, product-supplier combinations that reveal the highest risk when compared to the other groupings are still visible, allowing the firm to concentrate new efforts upon driving down risk even further.

In today’s cost-conscious environment, the more we can use technology to drive risk-based decisions, the better we will be able to manage those risks, and successfully! It has been TAG’s experience that some of the most sophisticated, global food companies struggle more with supply chain risk uncertainties than any other challenge. Perhaps the driver of this worry is the fact that the supply chain is viewed as an “accepted” risk, or maybe because the system itself is so large and cumbersome it seems too difficult to control. Our philosophy is to help companies understand how to get their arms around the challenge of supply chain risk and to make wise use of limited resources, and thus, we have developed this tool to achieve just that.

Irrespective of whether or not your brand is a household name, you have customers who rely on the safety of your product and expect good quality. In real terms, when your suppliers let you down and you don’t catch the problem — or you do, but you don’t intervene — you may then be, in reality, not just letting your customers down but your company as well. Thus, managing supply chain risk is not only a forthcoming regulatory requirement, it’s what you need to do to protect your brand.

No comments:

Post a Comment