Supply Chain Risk Management and Rocket Science

The aerospace industry was an early adopter of Failure Mode and Effects Analysis (FMEA) which, as the name implies, involves reviewing as many components, assemblies, and subsystems as possible to identify failure modes and their causes and effects. By Henry Canitz

February 25, 2016

I became very familiar with risk management early in my professional career.

I was working as a flight test engineer on experimental military aircraft, a world where the boundary between safety and expanding capabilities was often crossed.

The aerospace industry was an early adopter of Failure Mode and Effects Analysis (FMEA) which, as the name implies, involves reviewing as many components, assemblies, and subsystems as possible to identify failure modes and their causes and effects.

FMEA provided visibility into the most likely modes of failure and their level of criticality. Part of the process was to develop contingency plans, and I can tell you from personal experience that the FMEA contingency plans I helped develop saved lives on at least one occasion when the envelope was pushed just a bit too far on an experimental aircraft.

That aircraft entered a deep stall at 30,000 feet and recovered at 1,500 feet above ground. During that harrowing episode the flight test team relied on training and contingency plans to help save the lives of the flight crew.

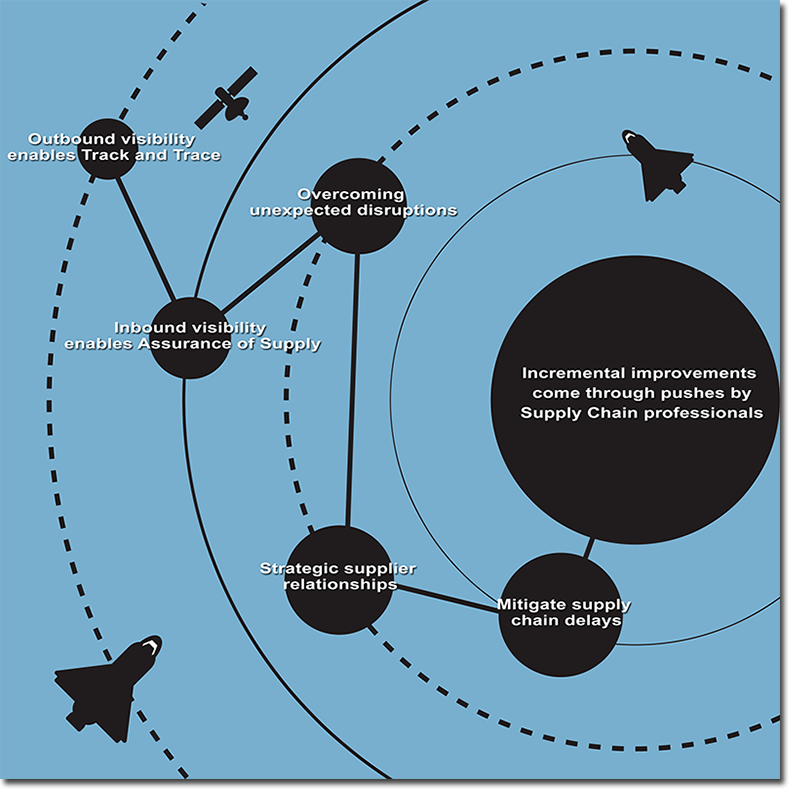

Supply chain professionals have to push the envelope on processes and procedures every day to gain incremental improvements in customer service, costs and efficiencies. As in the aerospace industry, pushing the supply chain envelope involves increased risks that need to be analyzed and mitigated, if possible, or at least planned for. Each stretching of the envelope generates unique risks.

For example, international product sourcing strategies aim to drive down per unit acquisition cost. Product selling strategies aim to gain market share. Expansion strategies often inadvertently drive up the complexity and cost of international transportation, which in turn injects a multitude of risks. Instead of dealing only with domestic LTL/TL or rail andintermodal shipments spanning days from dock to dock, the transportation department finds itself immersed in dray moves, port and custom delays, and ocean container moves with total transit times measured in weeks. Those sources of risk must be considered and planned for, perhaps mitigated by placing costly “just-in-case” raw, component and finished goods inventory at strategic locations to ensure the plant is not shut down and the customer is not effected when (not if) a supply chain disruption occurs.

Another envelope pusher is the effort to form strategic supplier relationships, which often leads to a single source of supply for key components: supply chain teams must consider the health of their strategic supplier, the macroeconomic environment in which that supplier operates, the on-going quality of components before they leave the supplier facility, and the variability of supply—not only from a production output standpoint but also due to transportation delivery variation. Ensuring strategic suppliers are kept on-track can be exhausting. These risks can be mitigated by identifying, certifying and managing alternative “just-in-case” suppliers who could supply the critical component at a much higher cost.

Unexpected disruptions (the seemingly endless list includes volcanic eruptions, tsunamis, hurricanes, tornados, earthquakes, snow storms and many others) are bound to affect global supply chains on a regular basis. The only logical strategy is to develop contingency plans that can be quickly executed when such disruptions take place.

A more proactive and cost-effective approach to handling the inherent risks and disruptions that come with increased supply chain complexity emphasizes partner communication and collaboration to increase visibility into the transactions and movements taking place. Shipment Status Messages generated through EDI or Supplier Portals provide the means to proactively manage shipments using exceptions and alerts. Shipment status information is the equivalent of shining a light onto your supply chain and illuminating details around every aspect involved with getting product where it needs to go.

Inbound visibility enables Assurance of Supply, allowing the shipper to remove “just-in-case” inventory that is held to counteract inbound shipment uncertainty, while at the same time making sure the plant is not shut down due to late supplier shipments. Inbound visibility can be enhanced by collaborating with key suppliers to gain early notification of what product and how much will ship on what day instead of waiting to see what you get when it arrives on the dock. A manufacturer with adequate visibility into supplier operations can often reduce costs through inbound route pooling and more favorable freight rates while simultaneously improving on-time arrival performance.

Outbound visibility enables Track and Trace, allowing the shipper to provide more accurate delivery information to customers and notify them when a shipment is going to be delayed. In today’s complex, supply chain where envelope-pushing is rampant, the dream of achieving on-time, in-full deliveries 100% of the time is just that, a dream. A customer that is proactively notified ahead of time that a shipment will not be on-time or in-full is more willing to forgive a service failure if they have the ability to enact contingency plans that minimize the impact on their end customer.

So the need to proactively manage risk, while often a life-and-death matter in Aerospace industry, can be a pretty urgent component of Supply Chain Management as well. The cost of failure may not be quite as dramatic, but losing a large customer or significant market share due to service failures can be detrimental to business success and long-term job security. No, supply chain management is not rocket science, but we still need to take a closer look at Failure Modes and Effects Analysis. Exploiting these methodologies to mitigate supply chain risk can keep the company jetting on an upward trajectory.

No comments:

Post a Comment