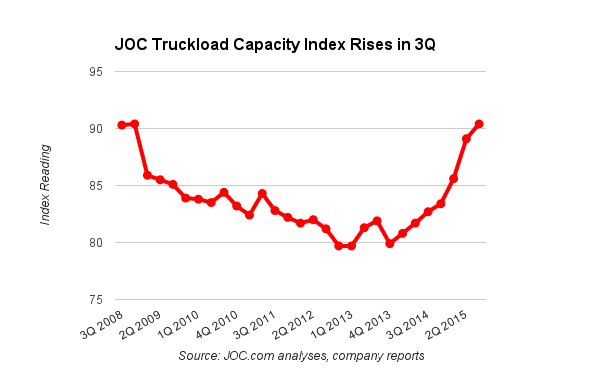

US truckload capacity rises to 2008 level, JOC index shows

William B. Cassidy, Senior Editor | Nov 16, 2015 1:51PM EST

Trucking companies may be short drivers, but there is no shortage of trucks in the U.S.

An influx of new Class 8 tractors pushed the JOC Truckload Capacity Index up 1.3 percentage points to 90.4 in the third quarter, the first index reading above 90 since the end of 2008.

The number of tractors operated by the truckload carriers in the JOC index group rose 9.4 percent year-over-year, with all carriers in the group increasing their actual truck counts. That compares with a 7.2 percent increase in the second quarter and a 1 percent increase a year ago.

The sequential quarterly increase in tractor counts slowed, however, rising only 1.5 percent last quarter after climbing 4.1 percent in the previous quarter and 2.7 percent in the first quarter.

That signals truckload carriers are throttling back on plans to add capacity, but also indicates many of the new trucks ordered in 2014 may have been delivered by the 2015 third quarter. Swift Transportation, the largest U.S. truckload carrier, cancelled orders for about 450 tractors.

The JOC index is based on “same fleet” figures that exclude acquisitions to highlight organic growth in capacity at a group of large truckload carriers with more than $10 billion in combined annual revenue. The index shows large truckload carrier capacity still almost 10 percent below its pre-recession peak, though one carrier in the group has already surpassed its 2006 capacity.

New registrations of class 8 commercial vehicles are expected to reach 250,000-plus units in the U.S. this year for the first time since 2006, and up from an estimated 229,000 units in 2014, according to IHS Automotive, a sister product of JOC.com within IHS. Forty-two percent of those vehicles are part of fleets with 500 or more vehicles, IHS Automotive said earlier this month.

That data supports the conclusion drawn from the JOC index: Large truckload carriers rapidly expanded capacity over the past year to do what they do with trucks, make more money. As they brought on more power, however, the U.S. economic recovery took an unexpected detour.

More trucks are now hitting the road than there is freight to haul, speakers said at the JOC Inland Distribution Conference in Memphis, Tennessee, last month, partly because forecasts last year didn’t include the buildup of inventories in 2015 and overestimated consumer spending.

“Did they (carriers) overbuy? No, they bought on anticipation of my business,” Jim Markey, vice president of logistics at tire distributor TBC Corp., Memphis, said at the JOC conference.

“We have not been seeing the volume growth in truckloads to support the amount of trucks coming into the marketplace,” said Kenny Vieth, president and senior analyst at ACT Research. Forty-five percent of the fleets surveyed by ACT in October reported a decrease in freight.

Typically, freight increases in October as the pre-holiday peak shipping season gets under way. This year is not typical, however. The once-sharp pre-holiday shipping peak has been blunted by higher inventories, which are suppressing orders for new stock and long-haul truck demand.

Those inventories are still high. The U.S. retail inventory-to-sales ratio rose from 1.47 in August to 1.48 in September, up from 1.43 in September 2014, according to the U.S. Census Bureau. Retail inventories rose 5.1 percent year-over-year to $584.3 billion in September.

It’s going to take some time — and possibly steep discount sales — to bring those inventory levels down to the point where replenishment stimulates demand for long-haul truckload carriers. High inventory levels in the third quarter could make fourth-quarter shipping demand seem flatter.

“Anecdotally we are hearing that shippers are coming into the market early for bids, which underscores the softening in the supply-demand dynamic as they look to take advantage of current weakness,” ACT’s Viethsaid in a statement on the decline in October freight volumes.

Also anecdotally, there are few reports of trucks parked for lack of freight, but depressed demand has kept spot rates low, and may bring more pressure to bear on contract rates. Trucks are more likely to be parked for lack of drivers, shipper and fleet executives said at JOC Inland.

Shippers that push carriers too hard on rates today could find themselves in a bind, however, if depleted inventories combine with stronger growth in 2016 to increase truck demand and tighten available capacity, or if winter storms disrupt supply chains as they did in the first quarter of 2014.

No comments:

Post a Comment