2015 Warehouse & DC Operations Survey Results

With the advance of omni-channel and e commerce, respondents are expanding facility size, experiencing an uptick in technology use, and applying more capital expenditures to outfit the added square footage - all positive signs of continued growth. By Roberto Michel

November 09, 2015

Most of the major dynamics we’ve been talking about for years in warehouse and distribution center (DC) operations - from the rise of e-commerce to growth in facility size, inventory turns, and stock keeping units (SKU) - are reflected in the results of Logistics Management’s Annual Warehouse and Distribution Center (DC) Operations Survey.

What’s more, although these dynamics pose challenges, the good news is that the industry appears to be up to the task, as seen in respondents’ increasing use of warehouse management system (WMS) software and other technologies combined with proven methods such as zone picking, observes Don Derewecki, senior consultant with St. Onge Co., our partner in this annual research project.

“The overall environment looks pretty positive,” says Derewecki. “People are using more square footage, higher buildings, and they need more employees to handle increased volumes and valued added services.

Also, they’re dealing with more SKUs and higher inventory turns.”

According to Derewecki, there’s rapid growth, and the pressures on operations are more intense and complex. “The encouraging thing is that companies are getting things done by employing more technology,” he says.

“Today’s operations are well beyond the simple manual environments that many industry veterans started out with”

This year’s survey also saw an increase in the use of third-party logistics providers (3PLs).

“The greater use of 3PLs ties in with the need to gain market share and quickly - and cost effectively - gain presence in a new region,” says Norm Saenz, managing director for St. Onge Co..

“Overall, the push toward omni-channel and e-commerce can be seen as a key factor behind many of the survey’s findings this year.”

In effect, this year’s survey reflects an industry expanding and facing up to omni-channel pressures, SKU growth, and more item and split-case handling.

Findings that highlight these changes include: the square footage for the average facility grew 25 percent; the average for annual inventory turns topped nine turns; 40 percent of respondents now service an e-commerce channel; and a significant number of respondents say that the value-added services they provide include lot tracking (40 percent provide it) and serial number tracking (30 percent involved).

Core Dynamics

In warehousing, no one adds space for the heck of it. They do it to accommodate growth and operations space needed as part of building out a successful omni-channel fulfillment facility.

In warehousing, no one adds space for the heck of it. They do it to accommodate growth and operations space needed as part of building out a successful omni-channel fulfillment facility.

This year’s survey certainly reflects the growth and change brought on by omni-channel - from more SKUs to the space needed to handle more volume, more e-commerce, and a continuation of the trend away from full pallets toward smaller shipping units.

This year, only 11 percent of respondents handle full pallets on the inbound side, down from 16 percent last year.

On the outbound side, full pallet only stood at 9 percent, the same as 2014’s findings.

On the inbound side, 44 percent handle case and split case; 26 percent handle full pallet and case; and 19 percent handle case and split case.

On the outbound side, the most common scenario (42 percent) is full pallet case and split case, followed by case and split case handling (29 percent) and full pallet and case (20 percent).

These basic characteristics reflect a deep change from years ago when handling full pallets on the inbound side was much more common, notes Derewecki.

The trend toward handling smaller unit loads is likely tied to e-commerce, both Derewecki and Saenz contend, though some of the trend may be related to trying to maintain leaner and lower inventories.

Forty percent of respondents now service an e-commerce channel, up from 34 percent last year. Only 12 percent say they service only one channel. The leading strategy for fulfilling multiple channels remains self-distributed from one main DC, practiced by 34 percent, down 4 percent from last year.

Those respondents who say they self-distribute from multiple DCs to fulfill different channels increased by just 1 percent. The big increase was the use of 3PLs for multichannel, as mentioned earlier. Fourteen percent now use a 3PL for all channels, nearly double last year’s 8 percent.

Both Saenz and Derewecki agree that omni-channel fulfillment is likely a contributing factor to a couple of the most significant findings from this year’s survey: SKU growth and an increasing number of inventory turns.

In 2013 and 2014, the number of SKUs declined among respondents, but this year saw a marked increase, from an average of 11,840 to 14,036 SKUs. That constitutes an 18.5 percent increase, which is more in line with what Derewecki and Saenz say they’ve heard from clients in recent years.

SKU growth complicates DC operations on multiple levels, notes Derewecki, from increasing the need for more pick faces and reserve storage locations to adjusting replenishment strategies and managing the labor tied up in replenishment.

Some of the growth in turns is likely related to the diverse items involved in e-commerce, but some of it might be coming from supply chain strategies that involve pushing products more directly to consumers or out to the retail level.

Growth in SKUs and turns reflects a more dynamic market reaching out to new channels or regions, says Saenz - a positive for growth, but a challenge for warehouse operations.

“In today’s marketplace, companies are looking at new ways to gain market share and increase sales with creative new products and new ways to get customers to buy from them,” says Saenz.

Technology and Methods

Investment in software and automated materials handling equipment is growing modestly or staying consistent with last year’s figures. And, reliance on manual methods continues to shrink compared to the past few years.

Investment in software and automated materials handling equipment is growing modestly or staying consistent with last year’s figures. And, reliance on manual methods continues to shrink compared to the past few years.

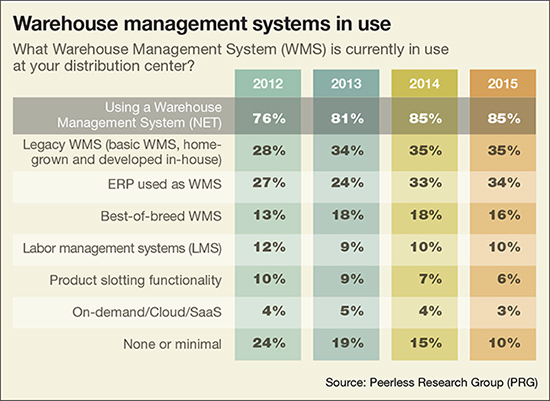

WMS use, for example, now stands at 85 percent when you combine the three main ways of acquiring the software: from best-of-breed vendors, enterprise resource planning (ERP) vendors, or maintaining a legacy system.

Four years ago, WMS use stood at 76 percent. “No or minimal” use of WMS is now at just 10 percent, compared to 24 percent four years ago.

This year’s findings also indicate that ERP vendors continue to make inroads in the WMS market. This year, respondents reporting that they use an ERP provider for WMS reached 34 percent, up from 27 percent four years ago.

Best-of-breed WMS use has also grown over the last few years, but did dip down 2 percent this year to a 16 percent response rate. Use of advanced software solutions held steady or declined slightly from modest starting points.

Use of labor management held steady at 10 percent, product slotting is at 6 percent, and on-demand/Cloud solutions have not garnered much response, hovering under 5 percent or under during the last four years.

As Derewecki and Saenz see it, small gains or steady levels of advanced technology use is not incongruent with rapid growth in square footage and capex. That’s because new facilities need core equipment like racks and lift trucks from day one and can add automation or more advanced solutions later.

Bigger and Bigger

To handle changes like more SKUs and e-commerce, the industry is expanding facility size, experiencing a modest uptick in technology use, and applying more capital expenditures (capex) to outfit added square footage.

Total square footage in the network averaged 570,700, up from 502,325. The median figure for total square footage climbed to 246,341 from 195,455 in 2014. Growth was particularly strong in networks with square footage of 500,000 and greater.

And, more employees are needed as networks grow. The average number of employees in a distribution network now stands at 287, up from 249 last year and 239 back in 2012.

With more and bigger facilities, actual capex investments are also trending up. The average capex investment for 2015 reached $1.2 million, down a bit from last year, but the median increased to $266,130 from $252,000, a nearly 6 percent increase.

Interestingly, 5 percent of respondents this year had capex of $10 million or more, up from 2 percent last year. When it comes to capex plans for 2016, the average projection increases to just over $1.3 million from just over $1.1 million last year, although the median for projections is down slightly.

Staying Green; Staying Resilient

The survey tracks sustainability initiatives and supply chain disruption experiences and actions. In terms of “green” initiatives, 92 percent had at least one initiative, with common efforts being recycling, energy efficient lighting, or use of fans to improve air circulation.

The survey tracks sustainability initiatives and supply chain disruption experiences and actions. In terms of “green” initiatives, 92 percent had at least one initiative, with common efforts being recycling, energy efficient lighting, or use of fans to improve air circulation.

The percentage of respondents who experienced a catastrophic event in 2015 reached 17 percent, up from 13 percent last year, but equal to the 17 percent response in 2013. Common comments on mitigation steps include business continuity planning, identifying alternate suppliers and routes, and investing in generators.

“The findings on supply chain disruption have remained pretty steady over the last few years at about 15 percent,” says Derewecki. “It’s an issue that companies take seriously, because top management insists on being prepared for potential disasters.”

Network optimization studies can help companies identify alternate routes in case of supply chain disruptions, but these studies mainly are needed to adjust for changes in demand, markets, and channels. Not surprisingly given the rise of omni-channel fulfillment, network optimization studies are being done quite frequently.

In fact, 44 percent of respondents now evaluate their networks at least every three years, and 26 percent do it as needed, likely based on changes to their business like acquisitions.

When asked about the biggest issues affecting warehouse and DC operations this year, the leading challenge was once again “insufficient space,” holding steady at a 43 percent response. Other top issues include the inability to attract and retain a qualified hourly workforce (39 percent); outdated storage, picking or materials handling equipment (34 percent); and inadequate information systems support (32 percent).

In sum, in the face of the rapid expansion in space and all the complexities around smaller, more frequent orders, respondents recognize that not only will better systems be needed, but they’ll also need a more tech-savvy workforce.

“To face up to today’s challenges, employees must have a basic understanding of how to use the various technologies that are becoming part of warehouse operations,” says Derewecki. “That’s a concern we see with this survey, and that we hear from our clients. There is greater need for training to be able use today’s systems.”

No comments:

Post a Comment