Where are the drivers going? Look no further than the warehouse

(PHOTO: SHUTTERSTOCK)

(PHOTO: SHUTTERSTOCK)

Pay has been listed as a top issue among truckers year after year, but it isn’t the only one. Another issue that has always ranked high is the time spent away from home—and in many cases there is simply no getting around it.

Another issue that doesn’t always make the headlines is simply the danger of the job. Trucking remains one of the most dangerous professions in the country. There were more than 1,000 fatalities among motor vehicle operators in 2016, according to the Labor Department. Being a commercial driver is a staggering eight times as deadly as being a law enforcement officer.

Supply is historically tight right now, and as the economy has boomed for the better part of a year now, trucking is considered a last resort job. Manufacturing and construction tend to compete for the same workers as those who drive trucks. Neither of those sectors requires any extra official training, such as truckers, who have to complete a surprising amount of training and certifications.

What you’ve probably not heard is that there’s another sector picking away at those potential driver candidates—and it’s in the warehouse. FreightWaves has documented the hot growth of the industrial real estate market over the past several months. We’ve covered ways to keep it lean and mean in the warehouse, as well as the need to modernize warehouses, and even this week, examined cutting-edge autonomous warehouse approaches.

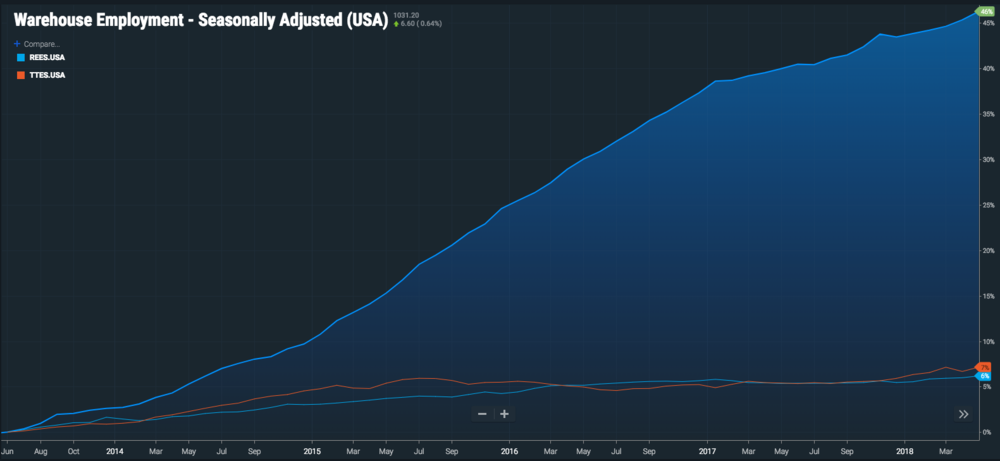

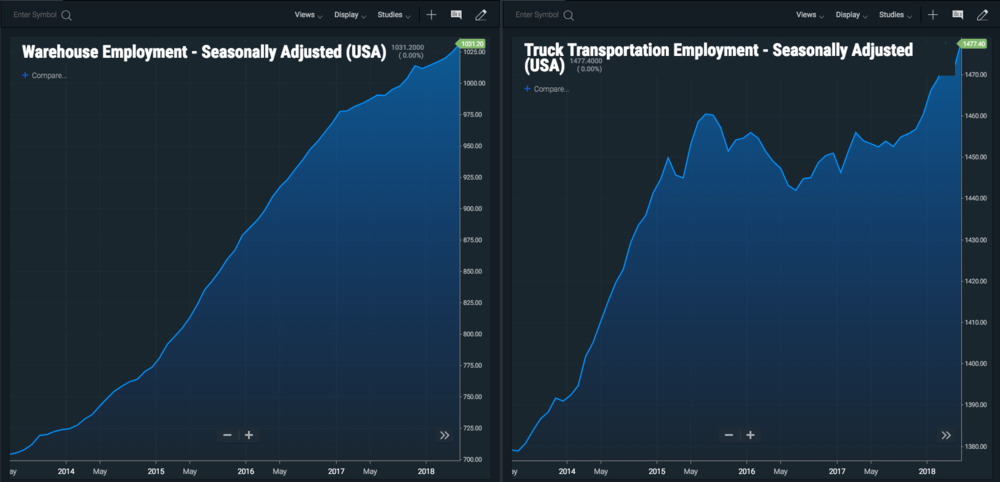

However, we have only recently uncovered the compelling trends through our SONAR Employment Data. Over a five-year period, the graph shows a clear disparity between warehouse employment growth as compared to the overall retail employment sector, and the trucking employment sector. Warehouse employment is up 52% while retail is up 7%, and trucker employment only up 6%.

OVER A FIVE-YEAR PERIOD, WAREHOUSE EMPLOYMENT IS UP 52% WHILE RETAIL IS UP 7%, AND TRUCKER EMPLOYMENT ONLY UP 6%.

If the trend holds, in the next 7 years warehouse employment will be larger than truck transportation. Currently the sectors are at 1.02 million for warehouse and 1.475 million for trucking.

IT’S NOT HARD TO SEE WHERE THIS IS HEADING IF THE TREND CONTINUES.

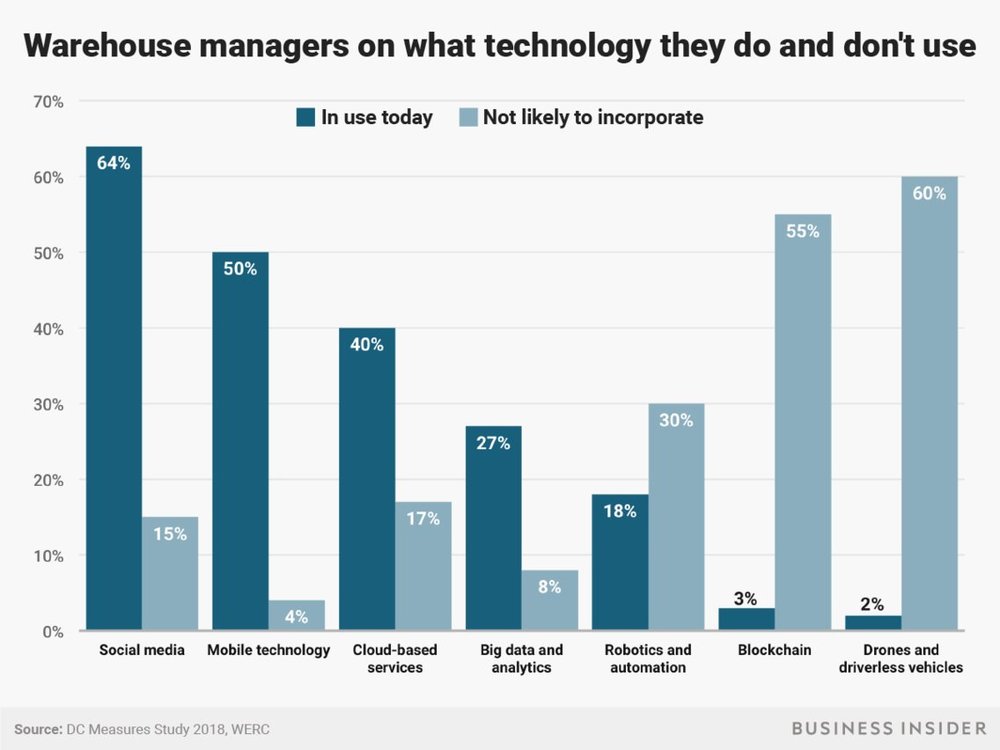

While the steady drumbeat for autonomous warehouses continues, especially from the likes of international majors, Alibaba and JD.com, it would seem that these are more things for headlines rather than the substance of boots-on-the-ground reality. Not only are the numbers telling us that employment is growing in the warehouse space, but so are the warehouse managers themselves. More than two-thirds of warehouse managers say people are the top priority in their operations, even as technology continues to make waves in headlines and at conferences, according to a recent survey by the Warehouse Education and Research Council (WERC).

The WERC report suggests people, not technology, are a facility’s greatest asset, and many have no plans to adopt emerging technology—even 10 years from now.

ACCORDING TO THE MOST RECENT WERC REPORT, IT’S ALL ABOUT THE PERSONNEL IN THE WAREHOUSE AND VERY LITTLE ABOUT THE HEADLINE-GRABBING TECHNOLOGY.

What else is happening? Shifting trends in manufacturing as they relate to e-commerce. Warehousing centers are getting closer to the end-user as well. Manufacturing is shrinking distance travel so it can keep inventory closer to the final destination. It’s all a function of the economy and the way that Amazon has pressed people into more regionalized networks. Amazon Prime is “kind of a big deal.”

Transportation costs in general are also increasing. Not only fuel, but also trade-related issues, and of course, having to pay drivers more and more. These could be mere “capacity crunch” issues, but so long as the economy thrives, they don’t seem to be going away.

Are we literally drawing a direct correlation to drivers leaving their jobs for warehouses? Of course not. On the other hand, the jobs are going somewhere, and they are certainly filling up the warehouses at a terrific clip. Could this be a part of the evolution of where the “new jobs” are going?

The majority of the trucking workforce is growing older. Over-the-road trucking could use a face lift with most Millennials. The median age of truckers is 10 years higher than that of other comparable industries, with a large number aged 55 or older. These drivers are reaching retirement over the next decade.

What will happen if capacity remains tight year after year? What will happen when the economy slackens? Truckers (and the industry) will adapt. They’re too essential, and this “ain’t their first rodeo.”

Meanwhile, however, many related jobs are heading–for now at least–into places like the increasingly efficient warehouses.

No comments:

Post a Comment