Ten calls. They are all starting to sound the same. Here is the storyline:

“We implemented SAP APO, and we now know its limitations. We have tried SAP IBP and are not impressed. Since SAP is not investing in improving the depth of their solutions for planning, we are looking for a new solution. Can you help us select a new approach? Which of these vendors do you suggest?” They then list a combination of Anaplan, Aera Technology, E2open, JDA, Kinaxis, Logility, o9, and OM Partners. Followed by a question of, “Which do you suggest?”

Then a young consultant from one of the large technology firms usually chimes in. “I have been mapping the process for end-to-end planning. We have been building an RFP. I can share it with you.”

I usually put the phone on mute and smile. RFPs and PowerPoint presentations are the worst way to buy decision support technologies like supply chain planning. Most consultants don’t know what they don’t know about planning. As a result, only 42% of companies rate their S&OP process as effective. This is especially true for forecasting. It is the flip of a coin.

I find that too many companies try to buy forecasting software through a Request For Proposal (RFP). The second mistake is treating it as the implementation of a technology. Instead, the selection process should start through data-driven discovery. The analysis should lead you to a small list of technology providers. In my experience, most companies ask the wrong questions and consequently have the wrong discussions.

I find that too many companies try to buy forecasting software through a Request For Proposal (RFP). The second mistake is treating it as the implementation of a technology. Instead, the selection process should start through data-driven discovery. The analysis should lead you to a small list of technology providers. In my experience, most companies ask the wrong questions and consequently have the wrong discussions.

Figure 1. The Effectiveness of Current S&OP Processes

What Do I Suggest?

Start your journey by understanding the problem. Begin a data-driven discovery.

- Analyze your data. How forecastable is your product set?

- Define the problem. What is the segmentation of demand patterns by intermittent demand, seasonal demand, phase-in/phase-out? Buy demand planning based on engine capabilities for the demand patterns.

- What is your Forecast Value Add (FVA) by product segment? High volume products? Promotions? Are you adding value to your current process? What is possible?

- How clean is your data? Can you easily get to three years of forecasts to backcast the data to analyze the forecasting engines? (Backcasting is the process of using prior year’s demand data to try to forecast the current year, e.g., 2015 and 2016 would be used to try to forecast 2017.)

- What is required for “what-if” analysis?

- How do you shape demand? What is required in the analysis for revenue management? What is the role of the demand process in this analysis?

- What is needed as a system of record? As an engine? User interface?

- What is your demand latency by product demand classification? What does this mean to your inventory buffer strategies?

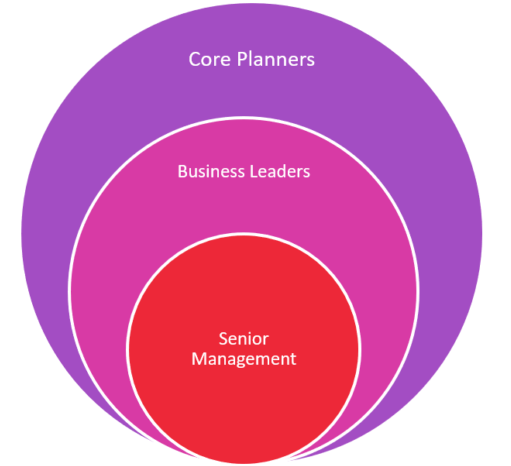

- Are you clear on the role of the technology for the planners, business executives and leaders?

Figure 2.

So, if you are one of the business leaders struggling with what to do next, start by helping yourself. Ask yourself the hard questions. Do not send the market into a tailspin with an RFP. (Most are just too vague to answer and waste everyone’s time.)

This type of rifle-shot of an RFP drill is a waste of time. These technology providers are very, very different. Invest to understand the differences before grouping them together for an analysis. This type of approach just demonstrates how little thought has gone into market intelligence.

Instead, roll up your sleeves and drive a data-driven discussion. Define the requirements. If unfamiliar with FVA, the SAS white paper is a good overview of the Forecast Value Add Methodology.

No comments:

Post a Comment