China’s Alibaba and JD.com invest billions in drones and robots to upgrade logistics backbone of e-commerce empires

China’s courier industry has boomed with the rise of e-commerce – investment in new logistics technology is aimed at reducing delivery times even further

PUBLISHED : Saturday, 09 June, 2018, 8:07am

UPDATED : Sunday, 10 June, 2018, 9:15am

In a wide-open space at the Hangzhou International Expo Centre, curious onlookers pulled out their smartphones to snap a quick photo or two of the many robots on display. In one area, a robotic arm was placing boxes on top of several tall, moving robots, which seemed to travel of their own free will to a separate sorting area before tipping their load into collection bags, marked for a myriad of different destinations in China.

In another exhibit at the annual Global Smart Logistics Summit, several automated guided vehicles (AGVs), reminiscent of Roomba’s robot vacuum cleaners, scuttled about hoisting metal racks stacked with piles of boxes. Everywhere you looked, high-tech logistics technology was on display, from autonomous drones that can carry a payload of as much as a metric ton to self-driving carts that can trundle along streets to deliver an array of packages to different customers.

These new robotic inventions are a sign of how China’s express delivery industry is striving to make deliveries even more efficient, whether it’s a fulfilment centre where tens of thousands of packages are packed a day, or over the ‘last mile’ of delivery, before packages are placed into the hands of eager customers.

And while delivery times have already been slashed in recent years, Alibaba’s founder and executive chairman Jack Ma Yun is so ambitious he would like to bring global delivery times for his logistics affiliate to under 72 hours – and he’s prepared to invest upwards of a hundred billion yuan to achieve this.

China’s courier industry has boomed over the last few years in line with the rise of e-commerce, with around 130 million packages now delivered to consumers in China every day – the highest number globally, according to Alibaba’s Jack Ma.

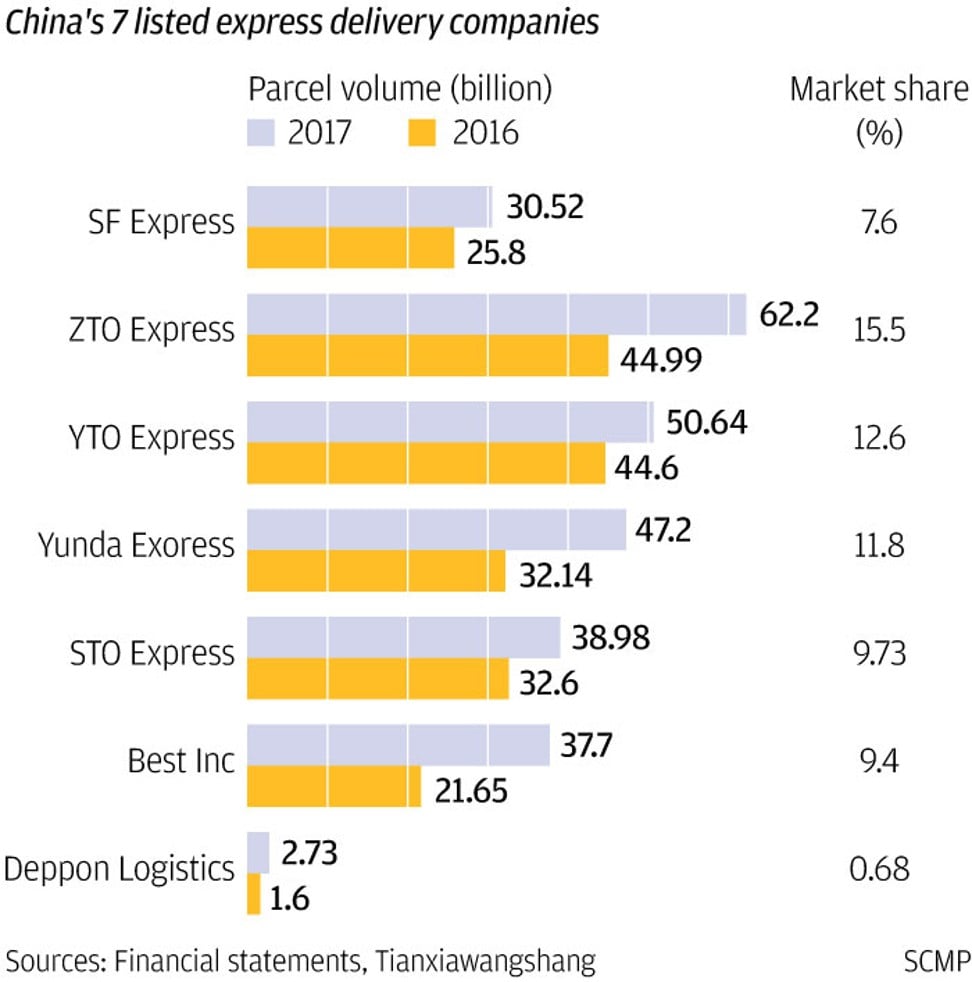

This surge in business has helped the founders of China’s biggest express delivery firms become billionaires. In 2017 alone, seven such firms went public. Today, the combined market cap of Chinese courier firms SF Express, ZTO Express, STO Express, YTO Express, Best Inc, Yunda Express, and Deppon Logistics adds up to about US$82 billion.

Express delivery services have expanded across the country so rapidly that packages sent within the same city, and even the same province, can now be delivered the same day. Delivery of packages between first-tier cities like Shenzhen and Beijing, can usually be completed within the next day.

“Five years ago, the average time it took for global deliveries was about 70 days … today, deliveries between China and other major countries can be done within 10 days,” Ma said at the Global Smart Logistics Summit in Hangzhou earlier this month.

China’s largest e-commerce firms Alibaba and JD.com, have played a large part in this boom, by investing heavily in building up logistics infrastructure as the companies have pushed to provide faster deliveries and better services to their customers. Alibaba is the parent company of the South China Morning Post.

“The development of e-commerce has helped to build up the logistics industry in two ways. First, it has attracted many new entrants into the logistics industry, pushing up the quantity as well as the service quality – which is measured by delivery time, percentage of on-time delivery and the goods loss/damage ratio, thereby leading to a better user experience,” said Neil Wang, Greater China president of consultancy Frost & Sullivan.

He added that the influx of capital into China’s logistics industry has prompted rapid modernisation as well as the creation of massive user information and logistics data, which can be leveraged to obtain insights that help companies improve their logistics and supply chains even further.

“The logistics experience is a vital part of the online shopping experience. Long delivery times and frequent delays, goods damage or even loss – will only drive customers back to physical shops,” Wang said.

However, JD.com and Alibaba have gone down different paths to build their logistics infrastructure.

Alibaba, which traditionally favours an asset-light approach, in 2013 established its logistics affiliate Cainiao, which partners with delivery companies to produce an open source, standardised logistics process that can provide insights to increase productivity. In contrast, JD.com decided to build a proprietary logistics network, constructing warehouses and hiring large fleets of deliverymen to service customers across the country in a model similar to Amazon in the US.

The two different approaches reflect the distinct business models of each company. Alibaba’s e-commerce platforms Taobao and Tmall are marketplaces that host third-party merchants, whereas JD.com started out carrying an inventory of goods that it sells to consumers directly. Direct-sales still make up the bulk of JD’s business although it has introduced third-party merchants to its platform.

Alibaba’s Cainiao meanwhile works with 15 main express delivery companies in China, and thousands of other delivery partners around the world, all of whom are able to use Cainiao’s data platform for everything from electronic input of waybills to big-data driven predictions of expected delivery volume during peak seasons, such as the Singles’ Day shopping festival.

According to the company, Cainiao has helped to standardise electronic bills and labels for express delivery companies, making it easier to electronically keep tabs on packages sent by Cainiao partners through just one platform. They’ve also increased delivery efficiencies and package volumes for couriers as merchants are able to select optimal routes and preferred couriers through the Cainiao platform integrated with Taobao or Tmall.

But in recent years, Cainiao has also started to invest heavily in building up physical logistics infrastructure and innovation. At the summit in Hangzhou, Ma reaffirmed that Cainiao would not run its own logistics business, but would put money into areas which its partners are unable or unwilling to do so.

“The scale of China’s opportunity in e-commerce means that companies have to be willing to invest in the capital resources needed to build out this network,” said Tom Birtwhistle, PwC’s China Digital Strategy lead. “In China, the couriers are still relatively low cost as a lot of the ‘last mile delivery’ is done by individuals on bikes … the delivery companies are not encumbered by some of the same wage challenges that you might face in Europe or parts of North America.”

After Alibaba took a controlling stake in Cainiao last September, it said that it would invest 100 billion yuan (US$15.6 billion) in building an efficient logistics network that would allow packages to be delivered within China in 24 hours, and globally within 72 hours.

As part of its efficiency drive, Cainiao has invested heavily in developing technologies with partners such as Quicktron, deploying automated guided vehicles (AGVs) that can carry shelves stocked with half a metric ton of goods.

Cainiao has also teamed up with state-owned automaker FAW Group Corporation to develop a fleet of autonomous trucks for long-distance delivery, as well as with autonomous driving technology company Robosense to develop “Little G Plus”, an unmanned logistics vehicle that is the first to use MEMS (Micro-Electro-Mechanical Systems) solid-state LiDAR (Light detection and ranging) technology for the vehicle’s autonomous functions.

The MEMS solid-state LiDAR sensor used by Robosense has a mirror just several millimetres wide to steer a laser beam in various directions and scan the surrounding environment quickly, enabling autonomous cars to “see” pedestrians, landmarks and potential obstacles.

MEMS solid-state sensor technology is expected to bring down the costs of LiDAR sensors for autonomous driving as it lacks moving parts, such as spinning mirrors, traditionally found in previous LiDAR sensors. The mirrors in LiDAR sensors were required to direct laser beams into the environment.

“MEMS will reduce the cost [of sensors] by about two-thirds, making it possible to mass produce driverless vehicles,” said Zhang Chunhui, head of Cainiao’s ET Logistics Lab in an interview.

He added that Little G Plus is currently undergoing trials on the streets, and has a driving speed of about 15 kilometres per hour – a sweet spot that is neither too fast (and therefore dangerous for pedestrians and drivers) nor too slow.

Another of Cainiao’s partnerships is with Beihang Unmanned Aircraft System, a spin-off company from Beihang University in Beijing, to develop a delivery drone that would potentially be the world’s biggest for civilian use, as logistics companies seek ways to deliver cargo to China’s more remote regions. The drone, which has a wingspan of nearly 20 metres and can fly 1,500 kilometres, will be able to carry over a metric tonne of cargo.

JD.com has also made a string of investments in logistics technology. In May, the company unveiled its autonomous truck technology, developed by its research centre in the US. This self-driving truck reaches ‘Level 4’ in autonomous driving, which is defined as “fully autonomous” and means it is able to perform all safety-critical functions without a human present, although it is limited to its “operational design domain”, according to an outline on autonomous driving by the US Department of Transportation’s National Highway Traffic Safety Administration.

“There isn’t much value if our technology can only cut three drivers down to two or even one. We want to develop a truck that is completely unmanned,” said Xiao Jun, president of JD’s X-Business Division, who said at a press event last month that its truck can handle open road driving but still needs to learn how to deal with traffic lights.

Like Cainiao, the Beijing-based e-commerce retailer has also developed small, self-driving autonomous delivery vehicles that are currently being tested on university campuses in Beijing, as well as delivery drones for rural deliveries, with a Delivery Drone Scheduling Centre operating in the city of Suqian in northern Jiangsu province.

JD.com’s network of 500 warehouses and almost 7,000 delivery and pickup stations means that the company can deliver 90 per cent of orders received either the same day, or within the next day, according to the company.

The innovation race is not limited to sorting and delivery. Companies are also focused on the customer experience, striving to find ways of making it more convenient for consumers to receive packages at any time of the day and increase the number of packages deliverymen can deliver at any one time.

Companies that operate ‘smart lockers’ have expanded rapidly in China. They’ve installed rows of lockers in apartment buildings that enable deliverymen to deposit a recipient’s item into a locker and send a text to the recipient with a code, which allows them to retrieve the package when convenient, thus eliminating the need for couriers to coordinate a delivery time with customers.

China Post is one of several companies in China that provides this service. Over 90,000 of its smart lockers have been installed in more than 80 Chinese cities, according to the company. A Cainiao-backed smart locker company called Hive Box, currently “delivers” about 7 per cent of China’s total package volume, according to the company.

At the logistics summit in Hangzhou, Cainiao also unveiled an invention it calls the Cainiao Box, a smart locker that consumers can install themselves outside their homes. It is horizontally expandable to accommodate larger packages, and can be temperature controlled in case the delivery consists of hot food, such as pizza. The box will also have facial recognition features that ensures only the customer can open it to collect their items. According to the company, many pizza lovers have already expressed an interest although the product is not yet publicly available.

Although Alibaba and JD.com are pouring billions into logistics infrastructure, China still falls behind many other markets when it comes to performance. In 2016, mainland China ranked 27 on the World Bank’s Logistics Performance Index, behind Taiwan (25th), South Korea (24th), Japan (12th) and Hong Kong (9th). The index measures and scores each market on the logistics environment, core logistics processes, institutions, and performance time and cost data.

Alibaba’s Ma said in Hangzhou that Cainiao aims to bring China’s logistics spending as a percentage of its gross domestic product down to less than 5 per cent, from about 15 per cent currently.

“China is an attractive market to build scaled supply chain solutions,” said PwC’s Birtwhistle. “Many make the mistake of saying China has experienced an e-commerce growth miracle, and so the same will happen in Southeast Asia and India, but penetration rates in these areas are still very low. If you don’t have a national or broad supply chain network then you … cannot serve the majority of the market.”

Southeast Asia is also an extremely fragmented market, with many islands and low levels of urbanisation, which make it challenging to build an efficient logistics network, he said.

Companies like Alibaba, having identified the potential of the e-commerce landscape in the Southeast Asia region, have worked with countries like Malaysia and Thailand to establish electronic free-trade zones and pumped money into investing in logistics companies such as Singapore’s postal service Singpost.

“When it comes to the supply chain, you need to invest ahead of demand,” said Birtwhistle.

No comments:

Post a Comment