E-Commerce: Not As Big As You Think

Summary

Yes, Amazon is reshaping the US retail market dramatically.

However, in a more global context, the US's example is fairly unique.

You can still be bullish on retailers with a non-US presence.

Heading into 2016, I suggested that it might be the year that Amazon.com (AMZN) lost some momentum while traditional brick and mortar retailers recuperated. That didn't happen. If anything, the existing trend became even stronger.

AMZN stock rallied from $650 to as much as $850, while the physical store retailers got shellacked yet again. The mall players had a dismal year all around, and even seemingly more insulated entities such as Target (NYSE:TGT) put in dismal results and now look increasingly un-investable.

Online Spending: Less Than You Think Even In The US

Yet, in all the negative chatter, it's easy to lose sight of the bigger picture. E-Commerce hasn't conquered the world; and in fact, it hasn't even conquered the American lower and middle class that lives outside of trendy urban areas. Take a guess at per capita spending in the United States on E-Commerce - and I'll warn you - your first estimate is almost assuredly too high. I'll reveal the answer in a second.

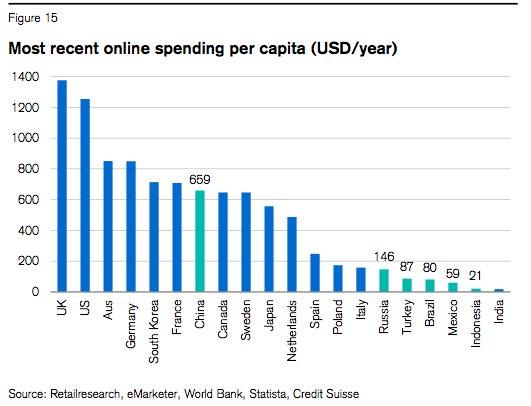

With that estimate in mind, now realize that the United States, out of major economies, has the second highest spend online per year. Only the United Kingdom purchases more through digital channels. Numerous highly developed countries, including Japan, Sweden, Canada, and the Netherlands spend half or less as much online per person as Americans. For all major emerging markets except China, online spend is less than 10% of what you find in the US.

In my previous Target article linked above, I highlighted the gargantuan advantage Wal-Mart (WMT) has from operating stores in dozens of countries where E-commerce isn't a big deal. Yet the commenters skimmed over this point. So let me state it again clearly: If you want to find a mass-market physical retailer that can succeed, make sure it has large operations outside the UK and US.

Wal-Mart, as the leading retailer in Mexico and Central America, along with having big positions in Brazil, South Africa, and various other emerging markets, is Amazon-proof for many years to come. Furthermore, its shrewd investment in China's E-Commerce rising star, JD.com (JD), gives it relevance in the one emerging market that is going digital at a much faster rate than average.

If you're just thinking about Wal-Mart and Target's US business/presence, you're totally missing the investment thesis. Target has hitched its future to physical stores in one of the two least hospitable countries globally to that strategy.

Now, let's think back to your estimate: How much do Americans spend online per year? Here's the data from Credit Suisse:

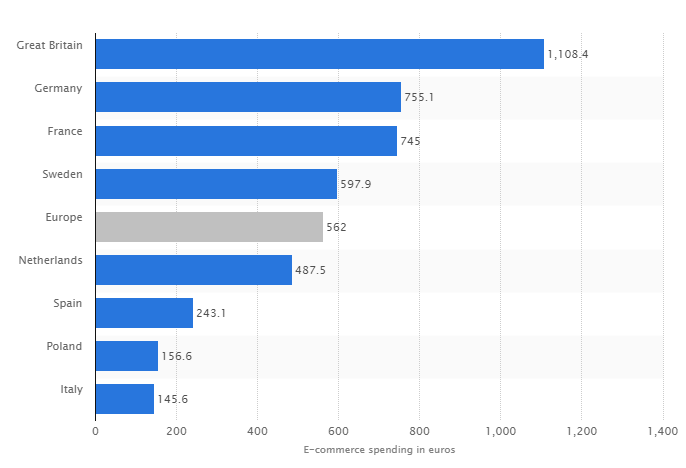

Since this sort of data is inherently difficult to collect, let's compare it with Statista's own data for 2016 European online spending (data in Euros, so add 5-10% mentally to adjust to dollars):

The datasets are fairly similar, and the takeaway is clear. People spend much less online than you'd think if you live in California or the East Coast and judge the whole world by that standard of digitization.

US per capita GDP is around $50,000, suggesting that only about 2.5% of Americans' total income is spent on E-Commerce. If you were wondering why discounter and dollar store business models are flourishing in the US, look no further. In wealthy enclaves, Amazon and other trendy app-based businesses do huge volumes, but out in middle America, there's a lot of people shopping physically at the sorts of stores that don't set up shop in major wealthy urban areas.

E-Commerce: Still Tiny Overseas

Globally, the lack of E-Commerce penetration is even more pronounced. The US is #2 out of major countries in E-Commerce spending, with no one other than the UK spending even $1,000/year online. Countries such as Spain and Italy spend under $300/year per person online - a drop in the bucket.

Turning to emerging markets, look at a country like Mexico, where I reside. US-based investors frequently ask me about Amazon and E-Commerce here, to which I say: What E-Commerce?

I hardly ever see Amazon boxes here (or local competitors either). And the data plays that out, Mexican E-Commerce came in at just $59/year per person - that's just 0.5% of GDP/capita. If you're long Fomento Economico Mexicano (FMX) like I am, because you assume people will keep buying staples like toilet paper, booze, and chips at their more than 15,000 conveniently-located points of sale rather than online, your thesis stands on solid ground.

China is the one emerging market where E-Commerce is in fact booming. At $659/year, China is competitive with far wealthier markets such as Canada and Sweden. That Chinese figure, in fact, means that nearly 10% of Chinese GDP is spent on E-Commerce, a far higher figure than you find anywhere in the developed world.

That of course, bolsters the bull case for JD, Wal-Mart, Alibaba (BABA) and other more specialty Chinese online plays. But don't generalize from the whole. The rest of the emerging world hasn't latched onto E-Commerce with any great fervor.

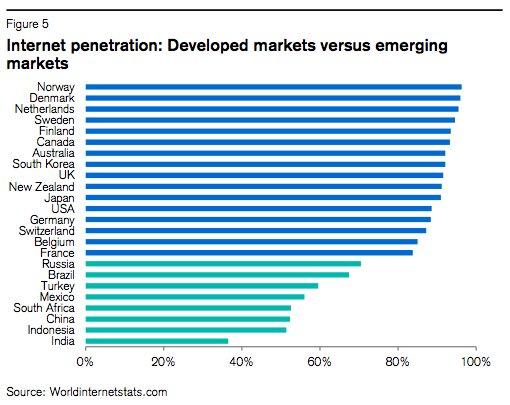

And that shouldn't be a surprise. Internet penetration remains under 80% in all major emerging markets, and just above 50% in most of them - internet is far from a universal human right yet:

Due to the high level of income inequality, countries with limited internet penetration can still put up high levels of E-Commerce spend. But by necessity, people with no internet access will buy little to nothing online. Physical stores aren't going anywhere in most countries, and big players like Wal-Mart will be there to profit.

Foreign E-Commerce: Still A Big Opportunity

While Amazon has pretty much locked down the US digital market, that's not at all the case overseas. In many markets, E-Commerce today is where it was in the United States 10 or 15 years ago. As a result, we're still very much in the early mover - if that - stage of setting up leading players in foreign markets.

Should Amazon manage to largely monopolize these overseas markets in the same way it has done in the US, it represents another big opportunity for the firm - one that, dare I say, may not be priced into its stock, even at these levels.

In all likelihood, however, in many of these markets, local competition will rise to the top spot, the same way that Alibaba and JD, not Amazon China, rule the roost in that country. Regional players such as Latin America's MercadoLibre (MELI) could develop into seriously powerful players over the next decade or two.

In any case, most foreign markets aren't anywhere nearly as digitized as the US market. And even in America, if you live in a wealthy urban area, you're probably significantly overestimating the amount of commerce that occurs online. Within that perception gap could lie some very profitable investing situations.

No comments:

Post a Comment