2017 Tech Retail Trends – Omnichannel Transformation

Omnichannel is critical, but 40% of retailers say that they are not yet getting an ROI on their omnichannel investments

At its CES breakfast in Las Vegas, two retail CEOs presented their view of omnichannel transformation in Europe, and CONTEXT delivered the highlights of the Omnichannel Retail Survey it conducted in December 2016. The responses from 31 European technology retailers, two-thirds of them in the C-suite, illustrate dramatically the transformation of retail to omnichannel.

While the focus last week in Las Vegas was on new products, CONTEXT hosted a CES breakfast on selling technology products in an omnichannel world. Retailers clearly recognise the critical importance of omnichannel transformation – 90.3% of responses to the CONTEXT survey said that omnichannel is critical or very important to their business, but 40% also said that they are not yet getting an ROI.

“Consumers are already omnichannel, but very few retailers are, because it is really hard and expensive to become truly omnichannel,” said Oliver Meakin, CEO of Maplin, as he opened the session. “Service and advice will be the key areas of differentiation in technology retailing in the future, coupled with good old retail-tainment – people like going shopping, and, therefore, omnichannel – rather than pure clicks – will ultimately win through.”

While the investments are substantial, they appear to be worthwhile. Retailers responded that they know they have to do it. 96.8% responded that they are transforming themselves to adapt to customer behaviour. The expectation is that omnichannel customers will engage more often, purchase more, and potentially add more items to their market basket. And yet, when CONTEXT asked the top tech retailers if omnichannel customers were more profitable, the verdict was not clear:

• 40% of tech retailers said yes, omnichannel customers are more profitable

• 30% said no, omnichannel customers are not more profitable

• 30% said they do not know

• 40% of tech retailers said yes, omnichannel customers are more profitable

• 30% said no, omnichannel customers are not more profitable

• 30% said they do not know

This mixed set of responses is indicative of two factors. Major omnichannel investments are relatively recent, so perhaps there has not been time to measure results. Additionally, it can be challenging for retailers to measure total customer relationships across time and channels.

“Do the consultants on omnichannel realise how difficult it is?” asked Hans Carpels, President of Euronics International, Europe’s second-largest tech retailer. Mr Carpels highlighted as an example the difficulty of setting up an omnichannel returns process with stores who are not the beneficiaries of that particular online sales.

There are no end of processes which need to be addressed in order to make omnichannel work. As Dr Chris Petersen, keynote speaker and retail expert said, “The whole is greater than the sum of the parts. You may have a great click-and-collect experience online, but if you wait for ten minutes to collect your goods, or the wrong product has been picked, that one piece breaks the whole experience.”

The reality is that is that transformation to omnichannel is happening in retail. It is significant that 19.4% said that they are well prepared for omnichannel, 74.2% said that they are making considerable progress and only 6.4% owned up to being not ready.

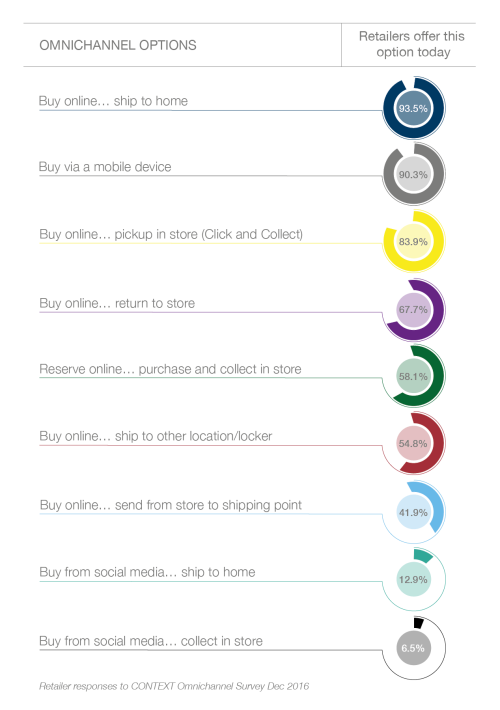

Clearly, other than sales from social media, the majority of retailers are now offering enormous variety in how they fulfil customer orders, whatever this may cost them.

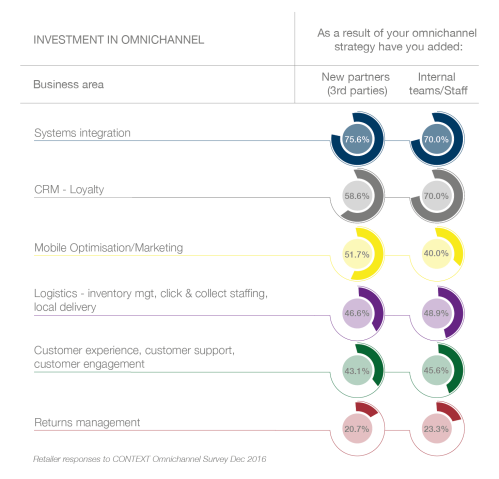

The level of complexity is evident from the different areas of investment which retailers have made. Systems integration tops the list, as it is essential to develop the web interface and link the POS system with logistics and CRM. Only returns management scored low, with just over 20% of retailers having added new internal or external resources in that area.

Our key takeaways

It is clear that omnichannel is not just the new normal for customers, but for retailers as well. There are some clear trends and calls to action for 2017. In the retailer transformation to omnichannel:

• Retailers will continue to invest in omnichannel but will have to manage programmes closely to ensure that they get the ROI on it, or they risk seriously weakening their financial position.

• We expect that omnichannel retailers will gain competitive advantage by increasing the number of categories and SKUs held online – in the survey, 80% said that they have already significantly increased the number of SKUs.

• Retailers will manage the inventory implications of omnichannel fulfilment by partnering with third parties such as distributors.

• Omnichannel success will be not based on one thing, but rather a collective enterprise approach involving merchandising, systems, technology, and logistics.

• Consumers do not think in terms of channels: they view their path to purchase as a seamless experience across their customer journey. As a consequence, the term omnichannel itself is no longer accurate. In 2017 omnichannel will become omniretailing.

It is a great time to be an omni-consumer and a very challenging time to transform to become an omni-retailer!

• Retailers will continue to invest in omnichannel but will have to manage programmes closely to ensure that they get the ROI on it, or they risk seriously weakening their financial position.

• We expect that omnichannel retailers will gain competitive advantage by increasing the number of categories and SKUs held online – in the survey, 80% said that they have already significantly increased the number of SKUs.

• Retailers will manage the inventory implications of omnichannel fulfilment by partnering with third parties such as distributors.

• Omnichannel success will be not based on one thing, but rather a collective enterprise approach involving merchandising, systems, technology, and logistics.

• Consumers do not think in terms of channels: they view their path to purchase as a seamless experience across their customer journey. As a consequence, the term omnichannel itself is no longer accurate. In 2017 omnichannel will become omniretailing.

It is a great time to be an omni-consumer and a very challenging time to transform to become an omni-retailer!

No comments:

Post a Comment