East Coast, Ohio Valley Snowstorm - Is Your Resilient Supply Chain Ready?

The image provided by NOAA National Weather Service Weather Prediction Center shows an early computer model forecasting the chances of a windy, strong sleet-snow storm hitting the East Coast this weekend, Jan. 22-23, 2016. By 24/7 Staff

January 22, 2016

Tens of millions of Americans from Washington to Boston and the Ohio Valley could be walloped by an end-of-the-week snowstorm, meteorologists say.

Although it’s still early, computer forecast models all see a windy, strong slow-moving storm. The big questions are where and how much.

“There’s going to be a big storm. Somebody’s going to get walloped,” said Victor Gensini, a meteorology professor at College of DuPage outside of Chicago, which should be spared. “It does look like it’s going to be a doozy.”

Rich Otto, lead forecaster at the National Weather Service’s Weather Prediction Center outside of Washington, said some major cities will likely see a foot or more of snow. Other meteorologists talked about 18 inches, two feet and more.

Gensini said the heavy snow is likely because the system will be slow moving. Forecasters see Saturday as the worst day in the East.

Early Tuesday, the Weather Prediction Center said the storm could be historic, but Otto said that may have been going a bit too far.

“Things will change; that’s a guarantee,” Otto said. “Nothing ever stays the same with these forecasts.”

Storms like this can impact the economy in many ways, ranging from short-term disruption to major financial damage, it can also servery hit logistics and supply chain operations.

This East Coast storm region is estimated to produce approximately $16 billion in daily economic output.

How Bad Weather Can Take Supply Chains by Storm - and How You Can Prepare

Bad weather is brutal for shippers, developing a proactive plan to deal with it is the best way to prepare yourself for whatever happens.

Bad weather is brutal for shippers, developing a proactive plan to deal with it is the best way to prepare yourself for whatever happens.

Trucks get stuck on congested, unplowed highways. Railroads can’t clear snow from the tracks fast enough for trains to get through. Snow and ice made it impossible for planes to safely land and take off. Like dominoes, one delay leads to another, disrupting supply chains across the country.

Many managers had developed lean budgets around negotiated rates. But those rates went out the window as service failures occurred. Rather than explore mode shifting to deal with the sudden capacity shortage, shippers rushed to the spot market to snap up capacity. Rates went way up.

Faster than some people expected, upper management came to call. They wanted to talk about why the transportation budget was so out of whack, but many transportation professionals were unprepared to explain it.

Like death and taxes, bad weather will occur sometime this year. Rather than leave things to chance, you can use these 8 tips to help you develop a plan to deal with the most common issues that arise with capacity and rates.

- Don’t try to time the market. There’s nothing wrong with seeking competitive rates at a given point in time. But there’s no more likelihood you’ll be able to time the truck market than stock market. Conduct a procurement exercise at the same time of year, every year. Reviewing rates and service providers every 12 months allows for better alignment of shipper and provider networks for long-term, sustained pricing levels.

- Maintain a stable set of service providers from year to year. This doesn’t mean you can’t add any new service providers. Competition is healthy. But before you choose, measure how much freight your carriers are actually hauling, compared to what they promised. If you’re giving too much to non-incumbents, it will show in higher rates.

- Understand what drives ongoing fluctuations in the market. Market changes affect availability of capacity. Truckload capacity, like the economy, is cyclical. While there are no foolproof ways to absolutely identify when a capacity shortage will occur, you can watch certain economic indicators to understand what is happening in the market and anticipate potential impacts on transportation rates.

- Shipper-receiver relationships can have a significant impact on the carrier’s engagement and satisfaction. That’s especially true when the carrier gets caught in the middle between two parties. Don’t leave them there. Shippers are ultimately responsible for resolving the issues carriers have with receivers. Ultimately, any negative treatment will adversely impact your relationship with the carrier.

- Be sure the transportation providers you are using are flexible. Can they step in and move additional freight volumes in a pinch? Do they have the size and scale to help you weather the storm time and again?

- Look for a link between your inbound and outbound transportation strategy that wasn’t there before. You may be able to have providers who deliver inbound raw materials supplement your outbound transport needs.

- Be flexible. Appointments do not allow for the most efficient transit time and use of a driver’s hours of service (HOS). Sometimes, the driver will be held up a day because a receiver has a small dock and too small a window for unloading.

- Communicate within your own organization. Educate your company (especially salespeople) about how weather affects capacity to avoid service failures and unmet expectations. Explain your plan for capacity this year. Will you ship early to avoid the rush? Leave inventory in strategic locations, balancing inventory carrying costs against (potentially) higher transportation rates?

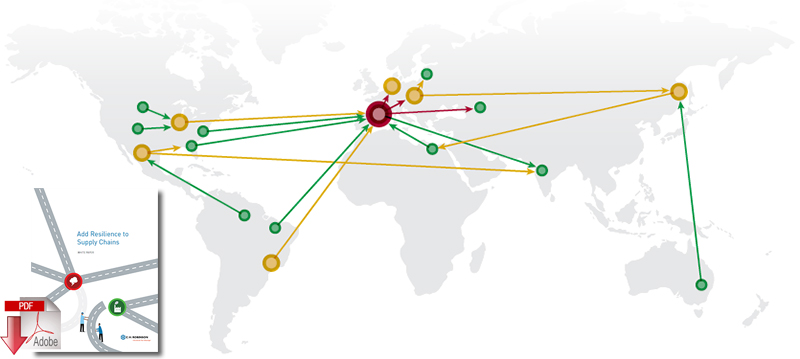

Perhaps the most important survival recommendation is to prepare to talk to upper management about the transportation budget. You can get some ideas for these conversations by downloading the White Paper “Add Resilience to Supply Chains”

No comments:

Post a Comment