Summary

3PL MANY-TO-MANY shipping networks get bogged down with Amazon’s volume; Amazon's move into air cargo will reduce peak season stress on those networks.

Amazon’s ONE-TO-MANY shipping network provides a strategic advantage for next-day fulfillment and value-added opportunities for growth in the LTL, small business shipping, and high margin international air cargo market.

Involvement in this market development by Atlas Air Worldwide and Air Transport Services Group provide a unique opportunity for value investors.

Fulfillment by Amazon (NASDAQ:AMZN) - Windfall for Atlas Air (NASDAQ:AAWW), Air Transport Services Group (NASDAQ:ATSG), & Kalitta Air; Saves United Parcel Service (NYSE:UPS), FedEx (NYSE:FDX), & DHL

Fulfillment by Amazon (NASDAQ:AMZN) - Windfall for Atlas Air (NASDAQ:AAWW), Air Transport Services Group (NASDAQ:ATSG), & Kalitta Air; Saves United Parcel Service (NYSE:UPS), FedEx (NYSE:FDX), & DHL

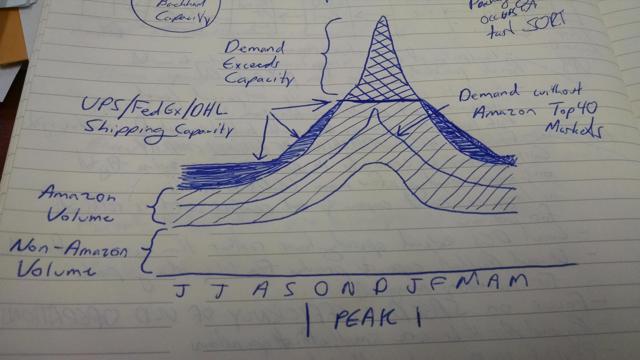

UPS, FedEx, and DHL, also known as Third Party Logistics Providers (3PLs) have built out significant PARCEL COLLECTION networks relying on volume efficient operations and numerous sorts to minimize the distance any one package needs to move.These networks can be classified as MANY-to-MANY. These networks are very good at picking up a parcel or pallet, moving it through the system, and delivering to the end user. However, these systems do not scale easily when receiving large volume shipments from a single supplier. To manage Amazon's volume demand during peak shipping season, these 3PL providers are forced to ramp up staffing, infrastructure, and fleets across the network at every hub and sort facility. Quite frankly, the 3PLs don't ramp up enough to handle the demand and the high peaking factor leaves a lot of equipment unused for a majority of the year. Parsing out shipments from Amazon's Top 40 Markets, representing about half the US population would asymmetrically reduce Amazon's utilization of the 3PL networks in major cities during peak season, precisely when the 3PLs see significant demand from consumers shipping holiday packages and where the 3PL network congestion is highest.Amazon's move away from the 3PLs in the major metros will reduce CAPEX and Peaking Factors for the 3PLs, drive efficiency improvements, and ultimately deliver better returns to investors in an industry which always seeks to cut costs.

Network Capacity

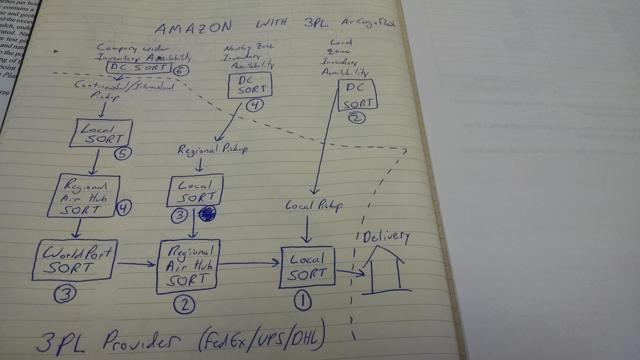

When Amazon ships product across the continent, the parcel will go through at least six sorts when shipped via a 3PL network. By utilizing its own network, the product would only be sorted three times.

MANY-TO-MANY NETWORK

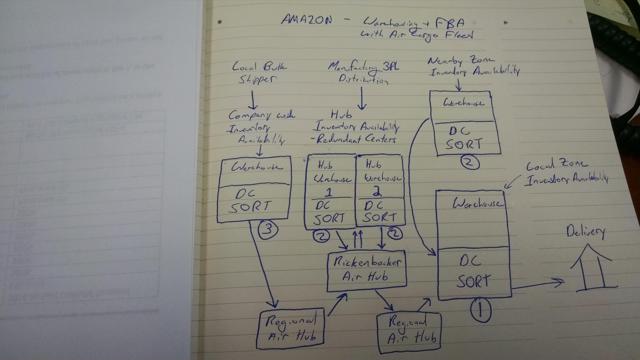

Amazon, however, is not building a MANY-to-MANY network. It is building a ONE-to-MANY network. 3PLs ship PARCELS; Amazon ships PRODUCT. This distinction is important as it removes a lot of complexity from the shipping process and optimizes the network for BULK PRODUCT SHIPPING. Amazon's network of Fulfillment Centers brings packers into the equation, an asset the 3PLs would be hard pressed to replicate without completely rebuilding the networks from the ground up.

Fulfillment Centers turn PRODUCT into PARCELs at the last step prior to delivery. It is very easy to take a pallet of goods at a central hub and break that pallet down by placing 25 trinkets into a ULD headed to Fulfillment Center A and another 50 trinkets into a ULD headed to Fulfillment Center B, and maybe 300 into a ULD headed to Fulfillment Center C, a locale that is clearly in love with said trinkets. These trinkets haven't been assigned a destination yet, rather just an intermediate destination. For example, Amazon's network has identified a need for 900 trinkets to destinations in the immediate area around Fulfillment Center C. FC C has 400 on hand, FC D is fifty miles away with 200 excess trinkets on hand which will be shipped via truck, and the remaining 300 will be shipped via Air Cargo from the Central Hub. As trinkets arrive at FC C, the items are then matched with a local name and address from the manifest, packaged, labeled, and shipped via 3PL or more likely Amazon Flex. It should be noted that the trinkets shipped from the Central Hub were not sorted en route to the Fulfillment Center at a Regional Air Hub. This allows Amazon's Regional Air hubs to be fairly simple, asset and personnel light operations. Amazon's utilization of 88"x125" Unit Load Devices (ULD) or pallets allow the company to take the approximately 25 main deck ULDs straight off the 767, slide 5 ULDs into a 53 foot trailer (of which Amazon recently purchased 'thousands'), and truck directly to the Fulfillment Center for local distribution via Amazon Flex.

ONE-TO-MANY NETWORK PHOTO

Amazon's network, particularly its Air Cargo network, with a focus on moving product from the Central Hub out to Regional Air Hubs, will always seek to fly full on outbound movements to shift needed cargo and also replenish local Fulfillment Centers. However, Amazon will only utilize the backhaul capacity to the Central Hub if there is an immediate need to shift product for distribution elsewhere in the network and there is no available stock at the Central Hub. Why is this the case? Amazon's database first searches the local Fulfillment Center for the product, if it is not there the database queries other Fulfillment Centers within reasonable trucking distance. If the second tier query is unsuccessful, a third query is performed at the Central Hub. If the Central Hub is out of product, or all of it has been previously assigned, the database queries the rest of the national Fulfillment Center network searching for the product. Once the product is located, and only if it has been requested, it is shipped to the Central Hub for further distribution. Whereas the 3PL Air Cargo network flights are fully loaded inbound and outbound from the central sort facilities during peak season, Amazon's peak season air cargo flights will always have significant excess inbound available capacity. Sounds great for Amazon; it is even better for Small and Medium Businesses that make trinkets but struggle to pack, sort, and ship across the US.

Amazon's Fulfillment By Amazon value add is that it can pickup a pallet of product and destination manifest from any shipper nationwide, ship it to it's Central Hub, and parse it out to the Fulfillment Centers, pack it, and deliver to the end user; overnight.The 3PLs would be hard pressed to replicate this at scale and provides Amazon a unique value proposition for the LTL market, Small Business shipping market, and HIGH MARGIN INTERNATIONAL AIR CARGO MARKET. These untapped market segments will provide Amazon with the ability to offset its organic Air Cargo shipping costs. TheRickenbacker Inland Port will, virtually overnight, become the favored International Air Cargo Gateway for distribution into the United States. Air freighters can operate on pendulum or line haul international flights, bookended with a stop at Rickenbacker in Ohio, where ULDs can be offloaded and sent to Amazon's two Central Hub Sort facilities for parsing out into ULDs bound for Fulfillment Centers across the US. Have an international shipment not bound for an Amazon Prime area? The 3PLs have Regional Air Hubs at Rickenbacker for cargo entry into those networks. It would not be a stretch to see four to five additional Central Hub Sort facilities across the US and Europe (perhaps one in Pacific Northwest, one in the Southwest, another in the Northeast, and two in Europe). These additional Central Hubs would significantly reduce the airborne ton-miles for shipments without significantly increasing the complexity or reducing the speed of the distribution operation.

Where's the trade?

We recommend holds for AMZN, UPS, and FDX. This development won't move the needle in a meaningful way for either of these companies.

We recommend buys for AAWW and ATSG. THE LOADSTAR indicates that Amazon is seeking sixty (60) 767 freighters for its use. Atlas Air Worldwide, Air Transport Services Group, and Kalitta Air are the three big domestic Air Cargo players. While Kalitta is privately held, AAWW is trading at a PE of 11.50, and ATSG is trading at a PE of 19.59, relative bargains when compared to AMZN's PE of 947.00. Sixty freighters, or even twenty to each would be a meaningful and sizable expansion to each firm's fleet and thus drive meaningful returns on the balance sheet. Atlas has strong Aircraft, Crew, Maintenance, and Insurance 'ACMI' and Crew, Maintenance, and Insurance 'CMI' segments along with experience in the overnight 3PL air cargo market, currently flying 11 hulls on extended dry lease to DHL. The ACMI and CMI segments are usually billed on an operating Block Hour basis with average utilization of ten hours per day, a leasing method well suited to Amazon's ambitions in the market. If Amazon chooses to buy the freighters as the planes come off the assembly line (presumably at a wholesale discount), use of CMI services would allow Amazon to be a huge player in the air cargo market without having the need to maintain an AOC. This would also allow AAWW, ATSG, and Kalitta to see earnings growth without carrying a lot of debt.

No comments:

Post a Comment