Surge in US transport, warehousing job openings recedes

William B. Cassidy, Senior Editor | Sep 30, 2015 2:18PM EDT

The supply of transportation and warehousing workers seemingly caught up with demand in July, as the number of hires in logistics industries equaled the number of job openings for the first time since last December, U.S. labor statistics show. However, the number of workers leaving transportation and warehousing jobs was also high, indicating significant churn in the workforce.

The U.S. Labor Department Job Openings and Labor Turnover Survey offers a view into a complex transportation and warehousing job market that is coming under greater stress as the overall U.S. employment rate drops toward 5 percent, close to the “full employment” level. Supply chain and logistics companies are preparing for an “unprecedented labor shortage.”

“While the labor shortage spans the whole supply chain, the shortages among warehouse workers and truck drivers are expected to be the worst,” the Council of Supply Chain Management Professionals and Capgemini Consulting said in a study released at the CSCMP annual conference in San Diego this week. The JOLTS numbers warn of trouble ahead.

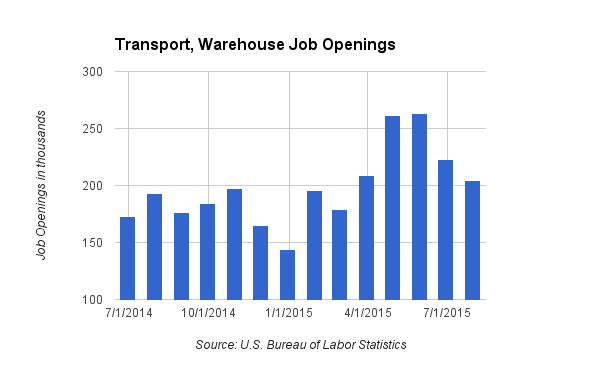

The number of transportation, warehousing and utilities jobs at the end of July was up 5.7 percent year-over-year to 204,000, the fifth straight month job openings in those industries exceeded 200,000, according to the U.S. Bureau of Labor Statistics. However, the significant surge in job openings peaked in April and May at just above 260,000, and has slipped 22.4 percent.

That’s not surprising, as transportation and warehousing businesses ramped up hiring in the second quarter to meet increased demand, most likely including personnel needed to handle freight breaking free of the logjam caused by the West Coast port labor dispute, which stymied supply chains and caused a massive inventory buildup in the first and second quarters.

Come the third quarter, freight demand typically moderates, which would take some pressure off transportation and warehousing companies looking for workers. Transport job openings would typically slide in the third quarter before picking up in the fall. Changing shipping patterns and events such as the West Coast port labor dispute have disrupted that “traditional” pattern.

The number of hires at transportation and warehousing companies continues to rise, however, increasing 7.3 percent year over year in July and 12.6 percent from June. At the same time, the number of “separations” rose 2.3 percent year-over-year and 16.6 percent from June, perhaps indicating an expected drop in part-time employment as well as unexpected departures.

The high number of hires and separations in July may point to the kind of payroll churn at transport and warehousing businesses that plagues many truckload carriers, where a single driver often is replaced several times a year, pushing up turnover rates. That type of churn would explain why the number of hires in July, 205,000, was higher than the number of job openings.

Truckload driver turnover rates, as measured quarterly by the American Trucking Associations dropped as driver pay rose over the past year. The average turnover rates for truckload carriers sank by 12 percentage points in the first quarter. If transportation and warehousing companies want to cut turnover and counter the threat of labor shortages, they may have to hike wages, too.

Changes in job openings and hiring trends revealed by the BLS data underscore the long-lasting impact of the West Coast port labor dispute. The confrontation over the multi-year longshore labor contract not only disrupted deliveries from last fall through this spring, it caused a buildup in inventories that helped spur transportation and warehousing hiring earlier this year.

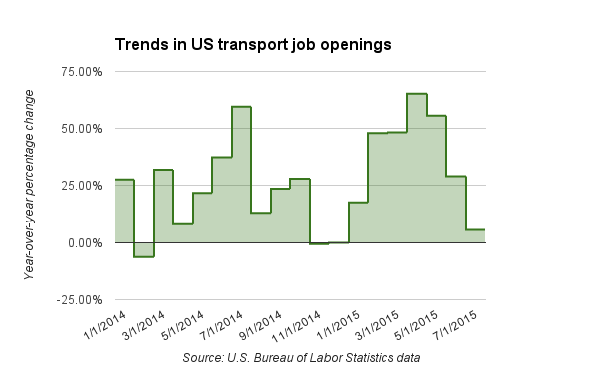

The annual surge in transportation and warehousing job openings peaked earlier and higher this year than last year, with the number of job openings rising 46.9 percent from February through May to the highest levels of the decade, easily exceeding the pre-recession peak of 186,000 set in September 2008. The annualized increase in job openings peaked in April at 65.2 percent.

The strong increase in job openings is hard to explain based on underlying economic growth alone. Although the U.S. economy expanded slightly in the first quarter, compared with the same quarter in 2014, growth overall this year has been more moderate than a year ago. The sharp buildup in inventories that began last fall provides some explanation for the intense surge.

U.S. business inventories rose 3 percent year-over-year in June to $1.8 trillion, climbing 0.8 percent from May, the largest sequential increase since January 2013, according to data released by the U.S. Census Bureau. The Census data shows U.S. retail sales rose 1 percent year-over-year in June, but inventories were up 4.1 percent. De-stocking is now under way at many U.S. retailers.

In 2014, when the U.S. economy expanded at a fast pace in the second quarter following severe winter storms, transportation and warehousing job openings increased 59.5 percent from February to July, peaking in that month at 193,000. In 2013, the spring increase in logistics-related jobs was more muted and short, with openings rising only 36.4 percent from March to April.

Without the West Coast port crisis, this spring’s jolt in transportation and warehousing job openings, as well as hiring, might have been more moderate, with fewer hands required to move freight. With inventory de-stocking dampening shipping demand in the third quarter, it’s not clear how much of surge to expect this fall in job openings and hirings at logistics operations.

Last year, the number of transportation and warehousing job openings jumped 11.9 percent from August through October, compared with an 11.4 percent three-month increase that ended in November 2013. How well logistics operators weather a muted peak season may depend on their ability to keep more workers from seeking jobs in higher-paying blue-collar industries.

No comments:

Post a Comment