Modernizing Your DC is More Cost-Effective Than the Alternative: Doing Nothing

Too often companies choose to do nothing to improve the operational efficiencies of their distribution centers, mistakenly believing that no investment in distribution means they avoid new costs. By Jeff Ross

October 22, 2015

The opposite usually is true in industries experiencing rapid growth. As the number of SKUs increases, or the volume of orders rises, more labor is needed along with additional pick faces and packing stations.

Productivity declines as bottlenecks intensify in crowded pick zones. Customers’ requirements also change, and companies risk significant penalties for delivery delays and errors - not to mention losing the customer altogether - when they do not modernize distribution operations.

How to Deal with Rapid Demand Growth?

How big is the opportunity hidden in the cost of doing nothing? One answer came when FORTE recently consulted with a North American apparel and accessories brand facing rapid growth.

How big is the opportunity hidden in the cost of doing nothing? One answer came when FORTE recently consulted with a North American apparel and accessories brand facing rapid growth.

Demand for two of its product lines was anticipated to each grow by as much as 50 percent per year. The forecast for each of the company’s two other product lines: 20 percent per year. Within one of the product lines, the retailer projected SKU growth of 25 percent per year.

At the same time, the retailer had outgrown its distribution center. With two buildings totaling approximately 85,000 square feet, plus storage already moved outside, the company had no unused space to add material handling automation.

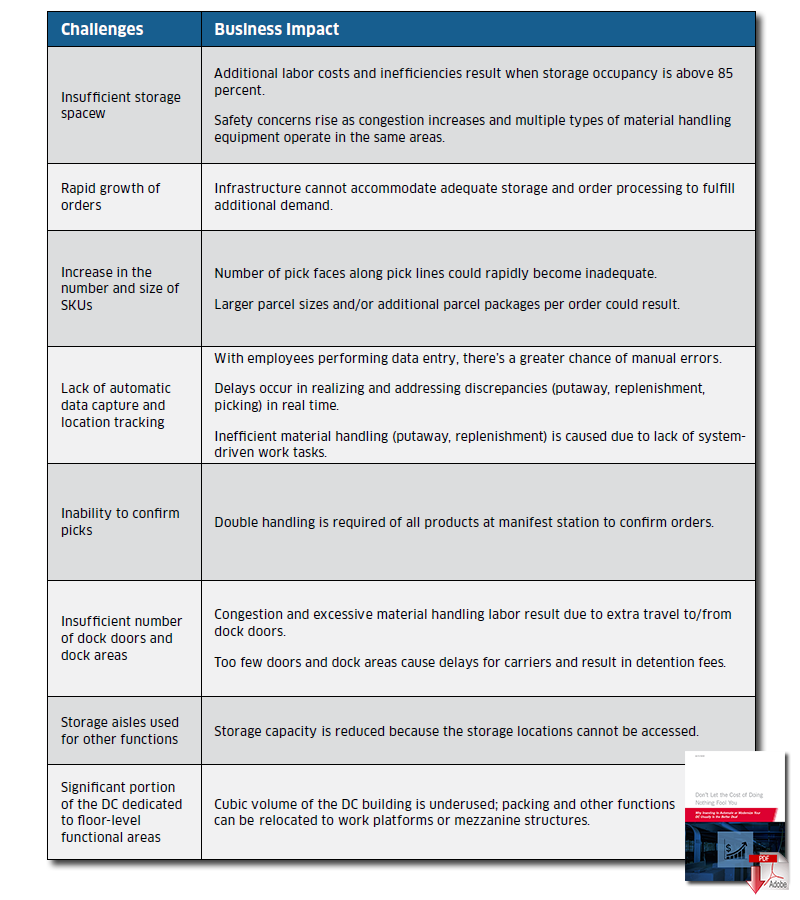

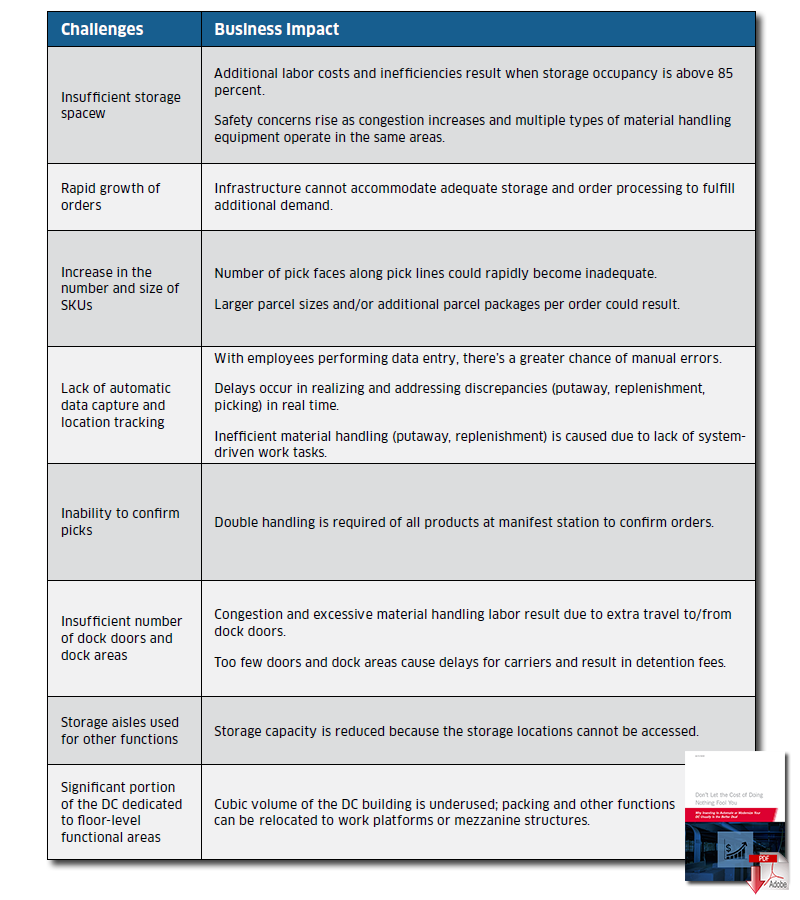

8 Critical Challenges

Here are typical situations in a distribution center for which the cost of doing nothing may be more expensive than the cost of investments to remedy them:

Whitepaper Download: Automating or Modernizing Your DC will Reap Great Long Term Savings

Here are typical situations in a distribution center for which the cost of doing nothing may be more expensive than the cost of investments to remedy them:

Whitepaper Download: Automating or Modernizing Your DC will Reap Great Long Term Savings

The DC could not keep up with the existing number of SKUs and volume of orders, let alone cubic inventory levels expected to quadruple during the next five years. Nevertheless, senior management seriously considered doing nothing to avoid investing an estimated $5 million to replace material handling equipment (MHE) and add a top-tierwarehouse management system (WMS).

They changed their minds after hearing from the FORTE team about what doing nothing would cost compared to investing to expand and modernize the retailer’s distribution operations.

To keep up with existing and projected orders, we calculated the additional number of employees needed and the escalating payroll costs for each of the next five years. Conservative estimates for labor ran from slightly more than $900,000 in the first year to nearly $3 million by the fifth year.

Even with additional employees, the retailer would struggle to keep pace with the expected growth in SKUs and order volume because its distribution center had no room for additional storage. Also needed: up-to-date sortation equipment and software to handle multi-channel distribution demands, track inventory, manage missing items and duplicate picks, and generate reports on productivity. Doing nothing to address warehouse capacity and functionality in this case would still result in labor costs more than doubling while jeopardizing the retailer’s ability to accurately deliver on time or fulfill new orders.

Recommendations for New Investment

At a minimum, we recommended the retailer invest slightly under $3 million to replace some of the existing MHE with new storage, pick modules and conveyor systems. The cost of doing something differently would be a step toward meeting order demand projections, but it would still not be a complete solution to meet all of the growing retailer’s needs.

At a minimum, we recommended the retailer invest slightly under $3 million to replace some of the existing MHE with new storage, pick modules and conveyor systems. The cost of doing something differently would be a step toward meeting order demand projections, but it would still not be a complete solution to meet all of the growing retailer’s needs.

After lengthy consideration because of the size of the investment, the company’s leaders chose our recommendation for the complete solution, spending about $5 million for new MHE and software to ensure the retailer could handle projected orders during the next five years and beyond.

In addition, the retailer selected the FORTE Smart Warehouse Suite™, our innovative approach to warehouse execution software that adds only the specific functionality needed in the new DC. Smart Warehouse Suite autonomous agents can be configured to provide the major functionality needed. This configuration enables the retailer to forgo buying complex warehouse management software, estimated at $1.8 million.

Not only is the Smart Warehouse Suite less expensive (less than half the cost of warehouse management software in this case), but using it to delay or eliminate the need to buy warehouse management software also avoids the risk of disruption in the distribution center. The deployment of a WMS can take 12 to 18 months and requires massive customization of coding to provide discrete functionality. Agents from the Smart Warehouse Suite can be implemented more quickly because they do not touch or change existing systems.

Results: Costs Saved, Quick ROI, Expanded Distribution Capacity

The apparel and accessories company responded to rapid SKU growth and throughput increases by choosing to build a modern distribution center with automated picking, sortation and packing. The retailer made a major investment in automation to avoid the very real costs of doing nothing, which would have included hiring workers to try to keep up with projected growth. In this case, the retailer can expect to save a minimum of $1.5 million in labor after five years; that’s a reduction in labor spend of at least 17 percent because of automation.

The apparel and accessories company responded to rapid SKU growth and throughput increases by choosing to build a modern distribution center with automated picking, sortation and packing. The retailer made a major investment in automation to avoid the very real costs of doing nothing, which would have included hiring workers to try to keep up with projected growth. In this case, the retailer can expect to save a minimum of $1.5 million in labor after five years; that’s a reduction in labor spend of at least 17 percent because of automation.

By selecting the FORTE Smart Warehouse Suite instead of a full-blown WMS, the retailer saved another $1.1 million - significantly speeding up the estimated return on investment in the project.

More important, the enhanced hardware and software in the new DC enables the retailer to accomplish these goals:

- Substantially improve picking productivity and increase picking capacity.

- Streamline the order fulfillment process by reducing process steps in the packing function.

- Provide dedicated pick lines for key accounts.

- Track inventory by location in the warehouse.

- Confirm picks and eliminate duplicate picks.

- Replenish based on predetermined minimum and maximum levels to reduce short picks and manage waves to sort orders by customer and carrier.

- Allocate pick zones dynamically.

- Report labor productivity.

A thorough review and analysis of this retailer’s distribution center highlighted what would happen to labor and other expenses if it did not expand warehouse capabilities. Armed with these insights, the retailer chose to expand and modernize its distribution center to avoid the cost of doing nothing.

Such costs are a big opportunity for DC managers and supply chain executives - when ensuring the cost of doing nothing is fully evaluated. They must be included in every business case when determining whether to invest in updating an existing warehouse or building a new one.

No comments:

Post a Comment