2018 Top 100 Logistics IT Market Research Survey

April 27, 2018 | Jason McDowell

Inbound Logistics surveys the supply chain technology market to evaluate the latest trends and uncover the most innovative providers in their respective fields.

MORE TO THE STORY:

Logistics technology research used to focus on a variety of siloed software solutions, but it has become so much more than that. A drastic shift from even five years ago, the Internet of Things (IoT) now links a wide range of hosted and on-site software solutions to each other, including transportation management systems (TMS), warehouse management systems (WMS), enterprise resource planning (ERP), product lifecycle management solutions, inventory management software, and a slew of others—some directly and others indirectly related to an organization's supply chain.

These solutions are tied to more data from hardware sources ranging from automated factory robots, to on-board truck devices, to GPS and RFID tags on cargo and packages. While the rise of big data once confused and intimidated some supply chain managers, the growth of artificial intelligence (AI) means all this gathered data gets handled efficiently with minimal human effort.

The wide availability of cloud-based Software-as-a-Service (SaaS) solutions means even small- and mid-sized enterprises (SMEs) can now afford logistics software. Both SMEs and larger shippers have extreme visibility over their freight and the ability to identify and track key performance indicators in their operations. Meanwhile, constant monitoring of—and easy access to—the spot market means shippers can negotiate the best rates right alongside their larger counterparts.

Tracking trends in the logistics technology market can be difficult for shippers who want to stay focused on their supply chain operation. This is why Inbound Logistics surveys technology providers each year to help you stay current on the latest and greatest technology providers. We take the pulse of the industry so you don't have to, giving you the information you need to make savvy choices that will boost your supply chain in the year ahead.

Our annual IL Top 100 Logistics IT Providers list showcases providers who lead the way in terms of innovation and best-in-class solutions. Our mission is to help you by providing a guide to top providers you can trust.

OH SAY, CAN YOU SEE?

Logistics technology developers want to help customers succeed. To do that, they must produce solutions that take into account the biggest obstacles those customers face.

Supply chain visibility took the top spot this year, with 82 percent of providers reporting it as a top challenge (see Figure 1). While visibility has been a top concern throughout the history of our Top 100 Logistics IT Providers report, this is the first time it has taken the number-one spot since we began asking this question. A 10-percent year-over-year increase suggests shippers are taking advantage of newly available technology that helps them track the safety and security of their cargo at every touchpoint.

FIG. 1 WHICH TRANSPORTATION/LOGISTICS CHALLENGES ARE MOST CRITICAL TO YOUR CUSTOMERS?

The reigning champion for the number-one slot since 2013—cost reduction—narrowly fell to the second position. Though down four percent from 2017, cost reduction remains a concern for shippers, with 81 percent of respondents reporting it as a critical challenge. With cost reduction and visibility in contention as the top two major pain points for shippers, it will be important for logistics technology providers to offer solutions that can increase visibility while remaining affordable.

Data management, customer service, e-commerce/omnichannel enablement, and inventory management also rate as top concerns for shippers—though not by nearly as many respondents as visibility and cost reduction—falling within the 46- to-56-percent range.

CLOUD REIGNS SUPREME

Fifty-two percent of technology providers report offering only cloud-based solutions, while 46 percent offer a mix of local and cloud services (see Figure 2). A meager two percent say they only sell local solutions, suggesting the days of on-site logistics technology may soon fade away altogether as shippers and other stakeholders invest in hosted, transactional solutions.

FIG. 2. HOW DO IT PROVIDERS DELIVER THEIR SOLUTIONS?

With the expansion of IoT solutions in the supply chain, and the aforementioned demand for increased visibility, it's no surprise 88 percent of logistics technology providers report organic sales as the primary driver of growth for their organization, with an additional 10 percent listing both organic sales and mergers and acquisitions (M&A) as growth drivers (see Figure 3). Only two percent attribute growth solely to M&A activities.

FIG. 3 . GROWTH IN THE PAST YEAR WAS DUE TO…

Transportation—including 3PLs, brokers, freight forwarders, warehouses, trucking, and everything in between—remained the top industry served by logistics technology providers, according to 87 percent of respondents, down one percent from last year's data (see Figure 4). Manufacturing, however, reports a sharp increase, narrowly missing the top spot as 86 percent of respondents list it as a served industry. This is a reversal of 2017's trend, when manufacturing experienced a slight decline.

FIG. 4 WHAT INDUSTRIES DO YOUR SOLUTIONS SERVE? FIG. 4 WHAT INDUSTRIES DO YOUR SOLUTIONS SERVE

E-commerce shows the biggest change year-over-year. Seventy percent of providers report serving the e-commerce sector, a big jump from 58 percent in 2017. The remaining sectors changed little, with the wholesale sector experiencing a one-percent increase year-over-year to 81 percent, and retail slightly dropping to 78 percent.

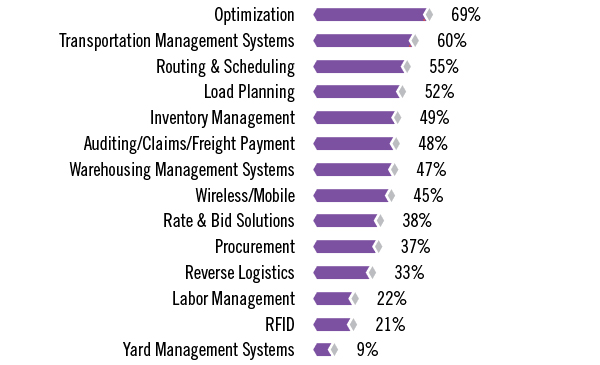

Providers continue to offer a wide range of both logistics and supply chain solutions, with primary products in both areas focusing on efficiency and visibility. For example, optimization (69 percent) and transportation management systems (60 percent) are named the top two logistics solutions, while supplier/vendor management (57 percent) and modeling/forecasting/predictive analytics (41 percent) top the supply chain list, demonstrating that shippers and other supply chain stakeholders are putting special emphasis on streamlining their operations (see Figures 5 and 6).

FIG. 5 LOGISTICS SOLUTIONS OFFERED

FIG. 6 SUPPLY CHAIN SOLUTIONS OFFERED:

One decade ago, the thought of hosting data offsite was a frightening prospect to many business leaders—supply chain leaders especially, considering the risks of supply chain disruption if data was lost or stolen. However, the viability and safety of the cloud has been proven, and cloud-based solutions have gained widespread acceptance in the business world. Shippers now enjoy the many benefits—including affordability and convenience—such a model can offer.

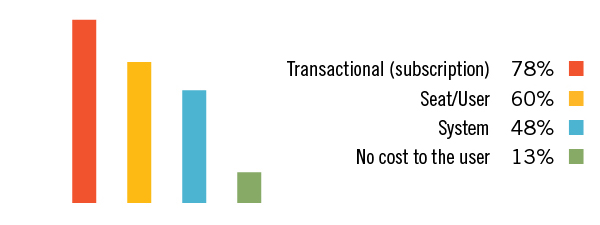

Providers report their customers are leasing rather than buying, with 78 percent paying for solutions through some sort of transactional/subscription model (see Figure 7). This figure has risen four percent year-over-year, while the per seat/user model also saw a rise of six percent.

FIG. 7 HOW DO USERS PAY FOR TECHNOLOGY SOLUTIONS?

Where's the demand for new logistics IT?

In its survey, Inbound Logistics asked logistics IT suppliers where they see growing demand coming from. Here are just a few of the many responses.

Real-time visibility. "Shippers across all industries are exploring more user-friendly ways of tracking their shipments in real time to improve exception management capabilities."

"Shippers are seeking real-time visibility technology for time-saving purposes, as technology allows logistics teams to instantly receive alerts on their shipments versus the traditional method of manually calling the dispatcher."

Big data. "Supply chain managers are increasingly looking to leverage data insights to identify cost-saving opportunities. Unloading/loading times and DC efficiencies are just some of the metrics logistics managers seek as they look to further optimize the supply chain while lowering costs."

New, modern software. "It's impossible to deliver a modern user experience on a legacy platform. Businesses are looking for new, modern software with a natural user interface created by designers (not just engineers) that reduces friction between people and provides critical business data."

Improved tracking/tracing. "We see a need for improved load tracking versus tractor or driver tracking. Drivers and tractors can change and a tracking device needs to be in with the load. Only then can you have true load tracking. This will also become more critical as autonomous vehicles hit the market."

"The product needs to be monitored throughout production through to retail or end user. TMS solutions need to aggregate all that information into easy-to-understand visuals and reports."

Cloud solutions. "We are seeing growth in cloud distribution solutions particularly in the chemicals, automotive, furniture, and industrial distribution markets."

Mobile apps. "Whether it's spoilage, damage, or theft, companies can no longer afford not to keep a close eye on their truckload freight. Mobile apps, combined with off-the-shelf sensors, make IoT-level tracking attainable, fast, and affordable."

Blockchain. "Though still in its infancy, blockchain has been characterized as a disruptive technology that, if widely adopted, could enable a giant leap forward in supply chain collaboration and automation."

E-commerce. "Smaller orders and each/single picking is on the rise across industries; technology to handle this will be essential."

No comments:

Post a Comment