The Power of Amazon Prime

Summary

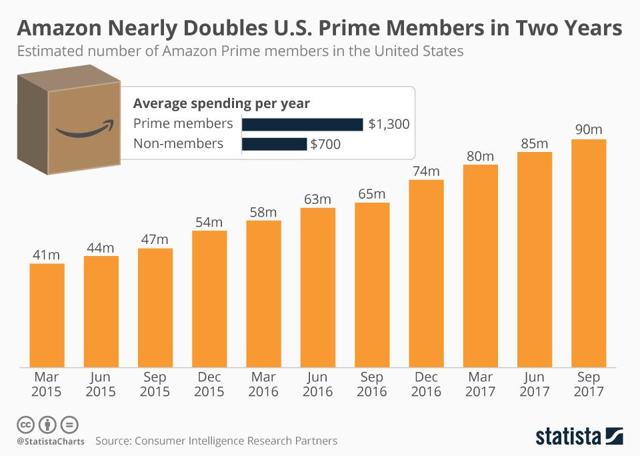

According to a recent study, Amazon Prime has grown to 90 million users in the US.

The study comes ahead of Amazon’s third quarterly report, soon to be released on Oct 26, 2017.

As Amazon aggressively launches Prime across the globe, investors may expect a strong growth opportunity.

But even though massive prime membership means good news for investors and Amazon, it comes with a few warning signs.

As the number of Prime membership goes up, investors should expect Amazon (AMZN) to dominate a larger market share both within the US and across the globe. The increase in Prime membership continues to add a promising revenue stream for Amazon and may only rise in the coming years.

A recent Consumer Intelligence Research Partners (CIRP) report finds that the number of US Prime members has increased to 90 million, up by 38% since last year (that’s double in two years). For Amazon, a growing Prime membership comes at a perfect time – a few days ahead of its third-quarterly earnings report.

Off late, Amazon has been shifting gears to disrupt a variety of sectors including grocery, video streaming, and fashion. A loyal Prime growth confirms that the e-commerce giant will cater to a larger global audience to keep members hooked through its integrated services. Additional factors like Amazon’s second headquarters only captures the tremendous future growth for the company. The recent race for the company’s HQ2 has already become intense, with the Seattle firm receiving 238 proposals from cities and regions across the US, Canada, and Mexico.

Launched in 2005, Amazon Prime has seen massive growth and, since then, the company has ensured that non-prime members understand that they are missing out on great deals and maybe a potential 30-minute drone delivery in the near future.

Launched in 2005, Amazon Prime has seen massive growth and, since then, the company has ensured that non-prime members understand that they are missing out on great deals and maybe a potential 30-minute drone delivery in the near future.

In 2015 Letter to Shareholders, Amazon’s CEO Jeff Bezos pointed out the importance of Amazon Prime. Calling AWS, Marketplace, and Prime as three “bold bets at Amazon that worked”, he further added, “We want Prime to be such a good value, you’d be irresponsible not to be a member.”

Like AWS, Prime has become crucial to Amazon’s vast growing business and Prime members are spending an average of $1,300 annually as compared to the $700 per year by non-Prime members. It’s no wonder that Amazon is aggressively expanding benefits for its loyal Prime members, simultaneously encouraging non-members to switch to Prime. The study shows that 63% of customers shopping on Amazon.com are actually Prime members.

This year, Amazon broke its third annual Prime record with sales up by more than 60% during the same 30-hr window in 2016. Prime day remains exclusive to Prime members and is a way that the company uses to encourage more annual Prime membership signups and to promote its own products like Amazon Echo.

But while Amazon Prime ‘lightning deals’ act as a bait for non-Prime members, for long-term investors the growing number of Amazon Prime means more value, a strong growth strategy and an increased domination of Amazon across different industries.

To start with, Prime membership costs $99 per year, or $10.99 a month. The extracted data from the CIRP report suggests that 90 million subscribers with $99 per year, could easily generate $9 billion in revenue. And with an average spending of $1300 per year than their non-member counterparts, they also appear to be loyal enough to contribute to Amazon’s long-term growth through purchases.

The CIRP study reveals that loyalty of Amazon Prime remains high and the rate of those “definitely” and “probably” renewing prime membership (once a member) has been 90% for the past few quarters.

Offers for Prime Members

Amazon’s constant efforts to engage more users through its Prime program is a strong signal that Amazon is keeping Prime core to its future business strategies.

In selected metros, Prime members get free same-day delivery on over a million items and free 2-hour delivery with Prime Now on daily essentials and groceries and free online streaming of videos. Amongst other perks, Prime members have access to video streaming service. With Amazon Studio investing heavily in original programming and in-house production, it is quite evident that its closest competitor is the undisputed leader, Netflix. Recently, The Economist mentioned that in 2017, “Amazon is expected to spend $4.5bn on television and film content, roughly twice what HBO will spend.”

This year Amazon announced Prime Wardrobe for its Prime members. The service allows them to order clothes, accessories, and shoes at no upfront cost and allows them to try it before buying it within seven days. The program is still in beta testing phase but the launch can bring significant disruption to the traditional fashion outlets. With free shipping and returns, Prime members will get discounts depending on the number of items they choose to buy.

This year Amazon announced Prime Wardrobe for its Prime members. The service allows them to order clothes, accessories, and shoes at no upfront cost and allows them to try it before buying it within seven days. The program is still in beta testing phase but the launch can bring significant disruption to the traditional fashion outlets. With free shipping and returns, Prime members will get discounts depending on the number of items they choose to buy.

Another benefit that Amazon has given to Prime members is through its recent purchase of Whole Foods. By significantly altering the system of grocery shopping, Amazon already slashed prices for shoppers after the takeover. The merger added benefits for Prime members, who will receive “special savings and in-store benefits” at Whole Foods. After the $13.7 billion merger, Moody’s estimated that 38% of Whole Foods customers or 5 million households were not Prime members. It further mentioned that half of these customers could switch to Prime membership by the end of 2019.

With its ventures like Amazon Go and Amazon Books, the company may also use the Prime membership to drive the hybrid plan of its brick and mortar system with online facilities.

Strong Logistics and Wide Demographic

Supply and logistics to meet rising demand of Prime members is not a huge problem for Amazon. Powered by a wide network of Amazon Hubs and fulfillment centers, Amazon already has a significant supply and logistics system in place. Unlike, traditional brick and mortar store which are slowly moving business online, the firm is not wasting any time in expanding its network for speedy and efficient delivery, which in turn will give it an edge over its competitors. Across the US, e-commerce giant already has 140 fulfillment centers where ordered goods are packed and shipped.

According to a new study conducted by Consumer Intelligence Research Partners, the US Prime members have increased by 38% from the previous year and there are now 90 million US members. The study also reflects that as many as 63% of customers shopping from Amazon.com are Prime members. Though Amazon does not release the numbers of its Prime members, a closer look suggests that increasing Prime membership remains core to Amazon’s vast business.

Amazon is gradually expanding the Prime membership to cater to a larger demographic – something that Snap and Facebook have been doing for a while now. Within this year, Amazon took steps to reach a wider audience, with special perks for Prime members. First, it announced a full year for the Amazon Prime Student Plan at a price tag of $5.49 per month. This is half the price of a standard Prime account. The Prime membership comes free for 6 months, subsequently leading to 50% off on a continued Prime membership.

But it’s not the college-going kids that remain a target audience for Amazon Prime. In another press release, the Seattle-based giant wooed teens between the age groups 14-17 years, providing them with their own login. If parents are Amazon Prime subscribers, then the teens also get access to benefits at no extra cost. The app login allows them to stream videos, games, and shop while keeping their parents informed.

The move to encourage shoppers to buy on Amazon and offer discounts is not surprising. A report by Pew Research showed that as many as eight-in-ten Americans are now online shoppers: 79% have made an online purchase of any type.

Global Prime Growth

Globally, Amazon is aggressively launching Prime. Amazon Prime Now (free delivery under two hrs.) has gradually extended to Asia, UK, and Europe. Amazon Japan has teamed up with pharmaceutical chains to deliver cosmetics and daily supplies within one hour after placing the order. Launched in 2012, Amazon in India is already the second largest e-commerce industry, competing closely with Flipkart (founded by ex-Amazonians in 2008). Amazon launched its prime membership in the country in 2016, with 25%-30% of Indian customers opting for it.

The two-hour delivery service, Prime Now service was recently launched for users in Singapore, a market that has been untapped by Amazon. The initial launch captured three times the order volume than it did for its first order in Seattle back in 2005, showcasing a huge untapped demand for the retail giant. Reportedly, the retail giant had to hail Uber to meet the delivery demand for its Prime Now members.

Warning Signs

But while the outlook may look bright for Amazon, there are warning signs when one looks at Amazon as the aggressive dominant company.

There have been reservations regarding the actual number of Amazon’s Prime membership. Amazon remains tightlipped about the number of its Prime members and only mentions that there are “tens of millions of Prime members around the world”.

So it may not be surprising if the official figures look very different and are in fact, highly inflated.

In the past, Moody’s led by Charles O’Shea had called CIRP’s 85 million US Prime members (reported last year) an “overstated” number, made “in the absence of any real guidance from the company itself.” Based on an evaluation, Moody’s believes the actual Prime members to be close to 50 million in the US. If this is to be believed, then the results will lead to a different math esp. around the revenues earned and costs incurred by Amazon.

Besides a debate around Amazon Prime, it’s worth to note that the click to Amazon Prime membership comes with high costs. Reports in the past by GeekWire suggest that the shipping costs for Amazon reached an all-time high of close to $7.2 billion in 2016, net of shipping-related revenue like Amazon Prime membership fees. Even the marketing spending to drive customers to its website is not cheap. Last year, this cost rose 38% in 2016, amounting to $7.2 billion and reportedly, went above the total spending of Wal-Mart Stores, Target, Best Buy, Home Depot, and Kroger.

While Amazon seems to be prepared for the upcoming cut-throat competition for quick delivery and competitive prices, its roadmap remains opaque. Many of Amazon’s fresh ventures like Prime Wardrobe and Amazon Go are in experimenting phase and the company could still be testing and mapping out efficient ways to cut shipping costs for free delivery to its Prime members.

The competition across the traditional retail is also just getting heated up especially after Amazon’s physical launch via Amazon Books. Given the nascent stage, it is difficult to gauge where Amazon will stand with its diversified ventures like Amazon Fashion and Whole Foods merger.

Through the hybrid, a system of brick and mortar and online experience, Amazon directly competes with tech giants like Google as well as with retailers like Walmart, Costco, and Target.

Many traditional retail stores are already shifting focus to online selling, creating bigger room for competition through collaborations. Recently, Google (NASDAQ:GOOG) (GOOGL) and Wal-Mart (NYSE:WMT) announced that Walmart products will be offered on Google Express, Google’s online shopping mall. Walmart was recently joined by Target to expand partnership for voice shopping.

Amazon’s Prime launch in China also faces hurdles that may impact the firm’s intention to compete for a global market share. Government controls, censorship and a strong presence of local rivals like Alibaba, Amazon Prime may take a while to launch in markets like that of China.

The words of caution that come with this disruptive force should not be completely ignored especially for investors who are looking for short-term profits or extremely safe bets.

Surely, Prime remains a very important growth driver for Amazon and as this membership expands in both scale and scope, the e-commerce giant will undoubtedly continue to focus on strengthening it – an investment opportunity that will result in generous results in the long run.

No comments:

Post a Comment