Trucking Freight Growth up Nearly 38% Since End of Great Recession

August 7, 2017

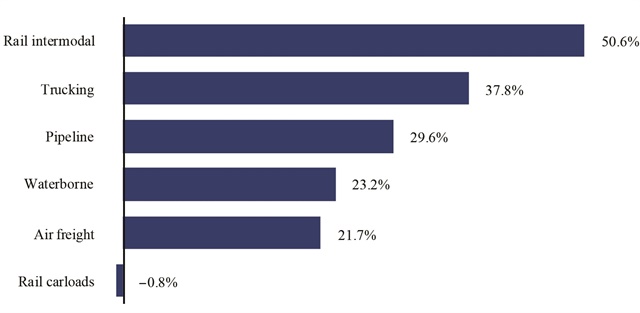

Newly released U.S. Transportation Department figures show all but one of the major freight modes have grown since the end of the Great Recession, with trucking posting the second-highest increase.

Trucking’s growth of 37.8% was bested only by rail intermodal, which rose 50.6% from June 2009 through December 2016, as measured by the department's freight Transportation Service Index. The index measures month-to-month changes in for-hire freight shipments by mode of transportation in tons and ton-miles, which are combined into one index.

The seasonally adjusted index showed trucking’s growth was followed by the modes of pipeline at 29.6%, waterborne at 23.2%, and air freight at 21.7%. During this period the overall freight TSI rose 29.7%.

The sole exception was rail carloads, which declined 0.8%. The drop in rail carload shipments took place at the same time as a decline in coal shipments. Total coal shipped by major railroads peaked in 2008 at 878.6 million tons before declining to 787.6 million tons in 2009, and continued to fall to 638.1 million tons in 2015.

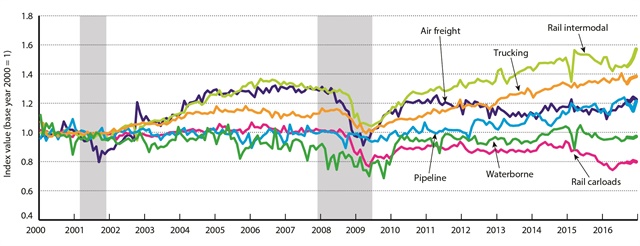

All freight transportation modes declined during the recession, and the freight TSI fell 16.3% from January 2008 to its low point in April 2009. The biggest decline was in the air freight index, 26.5%, followed by rail carloads, 23%; waterborne, 18.6%; rail intermodal, 18.1%; trucking, 14.5%; and pipeline, 4.7%.

According to the department, the freight TSI tends to turn in advance of slowdowns and accelerations in economic growth. The most recent data show two economic accelerations following the recession; the first from June 2009 to December 2012 and the second from July 2013 to December 2014. The freight TSI led both accelerations.

While the newly identified turns in the freight TSI continue to lead growth cycles, the relationship between the freight TSI and growth cycles changed in 2012.

The freight TSI reached a peak in December 2011 and turned downward 12 months in advance of an economic deceleration that began in December 2012. The freight TSI turned again, hitting a trough in October 2012, before the growth cycle peaked in December 2012 and turned downwards.

Historically, the freight TSI has not hit a trough and turned upwards before the onset of an economic deceleration. The economic deceleration began in December 2012 and ended in July 2013. The freight TSI peaked in December 2014 and turned downwards at the same time as the growth cycle.

No comments:

Post a Comment