Dr. James A. Tompkins Builds a Supply Chain

After years of writing about supply chains, Jim Tompkins is building out an ambitious e-fulfillment network for retailers and e-tailers, a collaboration, or rather an alliance, that will allow retailers to compete in “post-click logistics.” By Bob Trebilcock

January 05, 2017

If you’ve been around this industry for any length of time, you’ve either met Jim Tompkins, read one of his many books and articles, viewed one of his videos or heard him speak at a conference.

Or, perhaps you work for one of the many companies that has used Tompkins International’s consulting and design services.

I think it’s safe to say that there are few individuals who have devoted as much time and energy into analyzing and writing about Amazon’s impact on the retail supply chain as Tompkins.

What then is left to do? Well, after years of consulting and writing about the kinds of supply chains retailers need in order to compete with Amazon, Tompkins is putting skin in the game and building an e-commerce fulfillment network to provide “post-click logistics” to retailers.

The new venture, of which Tompkins is chairman and CEO, is known as The MonarchFx Alliance.

So, what is an alliance? As Tompkins explains, what he and his team are putting together is not a 4PL. Rather, it’s an alliance much like the way the airlines form alliances to combine or extend their capabilities beyond what any of the airlines could do individually. It’s not a 4PL because the alliance itself does not generate a profit.

In the case of MonarchFx, the alliance brings together a group of solution and service providers to offer more competitive distribution and transportation services than retail members could provide on their own.

It will include industrial real estate partners who will own the buildings; three 3PLs to operate the facilities; a technology provider (in this case, JDA Software); process design and automated materials handling solutions (Tompkins International and Tompkins Robotics); and two transportation providers, including one last mile delivery specialist for packages, or what Tompkins calls a delivery destination unit (DDU).

Tompkins says he got the idea for the alliance a little over four years ago, while doing research into Amazon’s network during a vacation cruise with his wife.

“I asked myself: Where is Amazon going to be in five years? And the numbers were unbelievable,” Tompkins says.

He notes that Amazon’s e-commerce business is about 5 times larger than the aggregate e-commerce sales of the next five players; and that the $37 billion he estimates Amazon will invest in its infrastructure between 2014 and 2018 is significantly larger than what those players will invest during the same period.

“Amazon already has a huge lead and is investing even more,” Tompkins says.

“It is close to the point of consumption by the customer and has the volumes in buildings that are very efficient. I concluded that the only way to compete with Amazon is to join an alliance: By having multiple clients in a building you get the volumes that justify the same level of automation as Amazon.”

While the idea sounded great on paper, it took Tompkins until October 2015 to secure the kind of funding required to make this a reality - and convince 3PLs to join him.

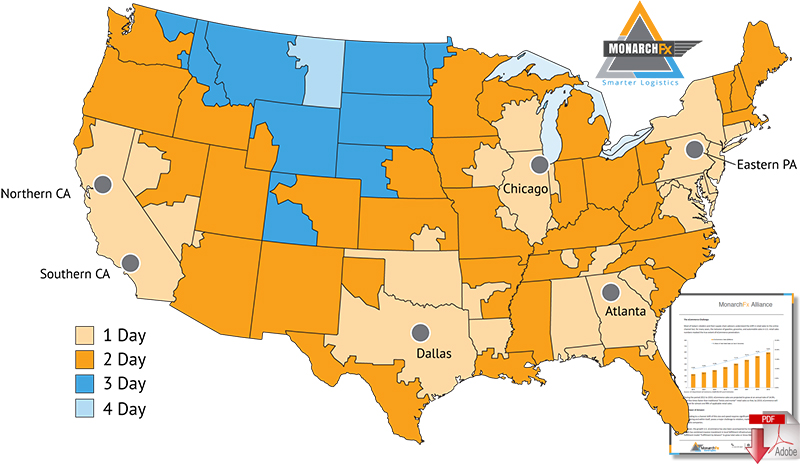

Initially, the alliance will operate six buildings in Chicago, New Jersey, Northern and Southern California, Atlanta and Dallas.

“Our six location design allows us to provide same day delivery to 20 percent of the US, next day delivery to 40 percent and two day delivery to the remaining 40 percent, other than a couple of locations in Montana and Idaho,” Tompkins says.

Like many e-commerce facilities, the buildings are designed around throughput rather than storage, with a high degree of automation to respond quickly to the marketplace. Eventually, Tompkins says the network will expand to 36 locations to provide more same- and next-day delivery. While the buildings will be designed around product types, initially, they will concentrate on apparel and footwear.

"The MonarchFx Alliance is the merging of supply chain & logistics companies with sellers to form a reinvented logistics ecosystem that is smart and innovative."

The alliance has a short list of “20 large retailers and brands that are very interested in participating,” says Tompkins, who will complete a preliminary pricing model in January, with plans to begin receiving inventory from alliance members next August to build up for the holiday season.

As Tompkins envisions it, a retail member may use the alliance to cover gaps in its current supply chain rather than build its own DC or turn to a traditional 3PL that may not have the same level of automation.

A menswear retailer, for instance, may have fulfillment centers in LA and Atlanta but is not able to meet customer service requirements in Chicago and New York.

That retailer could ship a small amount of inventory, say a week’s worth at a time, to alliance facilities for fulfillment. Next year, that same retailer may be doing something different, and use Columbus and Northern California.

“We are willing to give alliance members flexibility,” Tompkins says. “By pooling capacity, we still may not be able to match Amazon’s costs, but we can improve on what most retailers are doing today.”

And, in Tompkins view, this kind of collaboration - or alliance - is the only way retailers can compete in “post-click logistics.”

“I believe that ‘pre-click’ is where the real competition takes place,” Tompkins says.

“Retailers should work on their inventory selection, their pricing and their presentation,” he says.

“They can’t beat Amazon in post-click logistics, but they can compete. And, that allows them to be successful in their overall business.”

No comments:

Post a Comment