Retailers brace for 2017: Expect more store closings and major changes under Trump's tax policy

CNBC.com

128

SHARES

More upheaval is ahead for retailers in 2017, thanks to changes in the political landscape and consumer behavior.

Following a year in which several bricks-and-mortar players made big strides on the web (think Wal-Mart's acquisition of Jet.com, or Best Buy's three straight quarters of 24 percent online sales growth), the battle for second place is intensifying.

This shift toward digital is likely to reverberate through retailers' physical footprints, as they re-evaluate their needs for space.

Amid all of this change, it's becoming clearer that retailers need to take back control of their own destiny, so expect to see more brands that relied on third-party retailers to sell their goods getting more hand's-on.

All the while, economic and political changes will play a role on retailers' top and bottom lines.

As the page turns on 2016, here are five trends you can expect to see in the retail sector next year.

A new digital divide

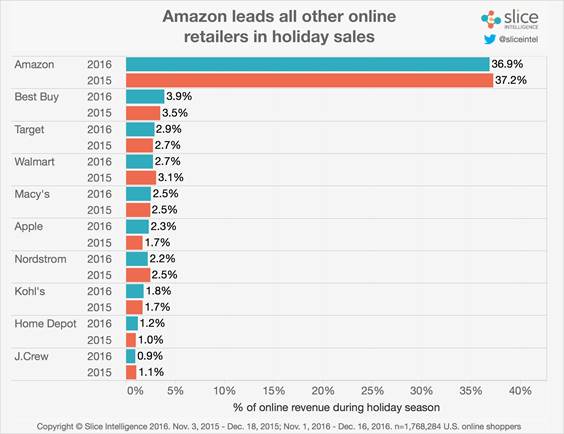

Though data shows that Amazon gave up a tiny bit of market share this holiday season, its massive online lead over bricks-and-mortar retailers is indisputable. Yet as the fight for second place heats up, a second type of digital divide is taking shape.

According to data from Slice Intelligence, which scans shoppers' digital receipts, the top 10 online retailers accounted for slightly more digital spending than they did last holiday season. This is a trend that Ken Cassar, the firm's principal analyst, sees continuing in 2017.

Because major retailers tend to have larger budgets, it's often easier for them to invest in their websites and faster shipping. As they make these types of improvements, they're winning the trust of repeat shoppers — who should help them continue growing their lead, according to Adobe Digital Insights.

"We are seeing the bigger retailers become more dominant," Cassar said.

He added that small, specialized shops with unique products are also performing well online, and that should continue in 2017.

Taking over control

Selling merchandise through a department store is a lower-risk, less expensive way for brands to grow their sales. Yet as these shops have become more promotional, labels including Michael Kors, Ralph Lauren and Coach are dialing back their exposure, in an effort to wean customers off of discounts.

Starting in February, Michael Kors will sit out department stores' broad friends and family sales, and will stop accepting coupons at those locations. In a slightly different twist, Coach started removing its product from wholesale shops this year, and will have exited a total of 250 before mid-2017.

Outside of the handbag space, athletic wear companies like Nike, Adidas and Under Armour are building out their own network of stores, where they have more control over the way their brands are presented. At Nike's new Manhattan store, shoppers can test running sneakers on a treadmill, or try new basketball shoes on a court.

"We create environments that bring our products and services together in a way that allows consumers to experience the Nike brand," Trevor Edwards, president of the Nike brand, recently told analysts.

Another wave of store closures

As the clock ticks on debt payments for struggling retailers like Claire's, and as hundreds of leases come up for renewal at healthier players, another round of store closings is ahead for the retail sector.

Shrinking department store Sears said in its latest earnings report that it will continue to close unprofitable shops as their leases expire. Roughly 80 percent of its 714 leased Kmart stores come up for renewal in less than five years, as do nearly half its 386 leased Sears stores.

About 50 percent of Abercrombie & Fitch's 745 U.S. leases will be on the chopping block over the next year and a half, the retailer said last month. More than 500 stores in American Eagle's fleet have leases that expire over the next two years, including 185 over the next 12 months, management said at the end of November.

"There was a big rush to do deals" before the recession hit, Naveen Jaggi, president of JLL's retail brokerage, told CNBC. Now that those 10-year leases are up, retailers have a chance to re-evaluate the importance of those stores in the post-recession era.

"They haven't seen that customer come back to the same level," Jaggi said.

Tax concerns

Retailers are keeping an eye on potential policy changes under a Trump administration next year. One particular topic they're monitoring is a proposed border-adjustment tax for goods that are brought into the U.S.

Though there are many moving parts that could dictate how dramatic the repercussions would be on retailers, Evercore ISI analyst Omar Saad said any potential benefit from a lower U.S. corporate tax rate would be "more than offset" by these challenges.

If passed, this type of policy change would take the biggest bite out of retailers who import much of their merchandise, including Gap and Urban Outfitters, analysts have said.

A resurgence at the high end

As income gains benefit the wealthy and the stock market soars to new highs, well-to-do shoppers will drive much of the spending boost in 2017, Customer Growth Partners President Craig Johnson said. That could deliver a much-needed lift to personal luxury goods like handbags, where sales are seen falling by 1 percent this year.

Separately, some have speculated that Donald Trump's election will bring back the feeling that it's once again acceptable for people to flaunt their wealth. That includes Nobel Prize winner Robert Shiller, who told CNBC last week that modest living is losing its appeal in America.

"You have to live big-league and you're on your way," the economist said.

Though lower-income shoppers are still facing headwinds from high health-care and rent costs, they will continue to benefit from low fuel costs and food deflation. In the end, that should translate into slightly higher spending, Johnson said.

No comments:

Post a Comment