Will C.H. Robinson Become A Dividend Aristocrat?

Summary

C.H. Robinson has raised their dividend for 18 consecutive years.

Their asset-light model and intelligent capital allocation should allow them to continue to raise it for years to come.

They should become a dividend aristocrat in 7 years, and are trading around fair value at this time.

C.H. Robinson Worldwide (NASDAQGS: CHRW) is a third party intermodal logistics company trading at or below fair value which has raised their dividend for 18 consecutive years, and I believe that they will join the PowerShares S&P 500 Dividend Aristocrats Index (NYSE: NOBL) in 7 years.

Customer base and carrier relationships:

CHRW has a huge number of customers, 110,000 active as of the end of 2015, the largest of which accounts for only 2% of revenue. This is indicative of any single customer going out of business not causing the company great distress financially. This forms a sort of moat for them, reducing the worry of a single event taking out a huge chunk of revenue, especially since their customer base is widely spread across all sectors of the economy. Relationships with around 64,000 carriers and suppliers provides the ability to meet all of their customer needs and is a competitive advantage over smaller firms. This allows them to meet the needs of many different types of corporation. Their original business started as produce delivery, which can be a tricky business due to how time-sensitive it is and the refrigeration requirements. Since then, they have branched out into ocean shipping, as well as air freight.

Technology ecosystem:

Programs run by CHRW now automate over 70% of all customer interactions. Basically, Navisphere, their flagship technology platform, allows for real-time updates as well as giving companies the ability to request quotes and view invoices. They have a mobile app for cell phones that gives similar functionality, as well, helping drive connectivity. Once a company gets comfortable using their program, they are less likely to switch. This sticky quality provides good retention and relatively consistent revenues. This is important, because their business is not recession-resistant. The ability to streamline and provide visibility in real time up and down the supply chain is a great asset to customers, and CHRW continues to invest money into their technology to stay ahead of the curve when it comes to customers' needs. They are building another data center to provide scalability to their customer support, and that represents the majority of the capex involved in their business.

Asset Light Model:

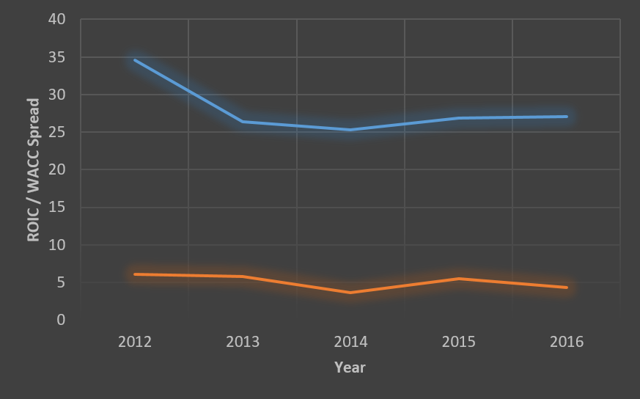

As a third party logistics provider, they run an asset-light model allowing for excellent returns on invested capital.

Source: GuruFocus

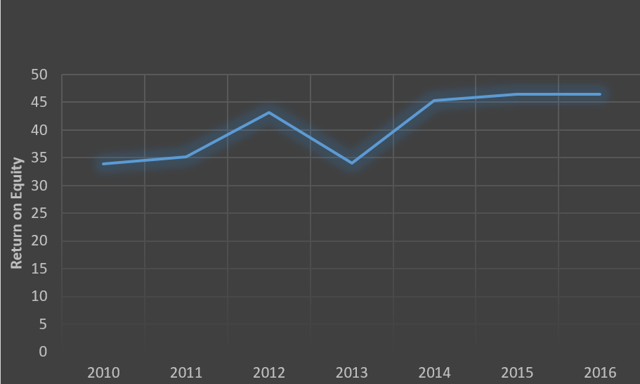

This ROIC-WACC spread shows the creation of shareholder value over time. It also shows that as they grow, they will continue to provide greater returns. Their ROE has been outstanding for years as well:

Source: Morningstar

This economic model also allows for a lot of FCF generation. Their ttm FCF yield of 6.28%, or $666M in FCF, allows for a lot of flexibility in their business, especially since they only have $500M in long-term debt on their balance sheet.

Dividend Growth and Sustainability:

As I stated above, they have grown their dividend every year for 18 consecutive years. The rate has been solid, except for a hiccup on the 3 year average, since it would be nice to see high single digit growth. They currently yield 2.29%, which may not be enough for current income seekers.

Source: David Fish's CCC List

I would expect to see closer to an 8% growth rate going forward, which is their expected 5 year EPS projection. With a payout ratio of ~45%, they have plenty of breathing room. Combining this with their earnings growth, FCF generation, and low debt load, they should be able to grow their dividend for years to come and become one of the dividend aristocrats.

Their business is directly tied to the economy. Of course, customers like grocery stores are going to continue to maintain a demand for produce in lean times, but there are plenty of customers who are linked to commerce and trade, which will see a decline in a down economy. So, how did CHRW perform during the Great Recession? Well, they didn't even have a dip in their earnings. They took a $1B dip in their revenues, but cut costs and increased margins by 150 basis points to raise earnings by 2% from 2008 to 2009. Their ability to maintain profitability is evidenced by the return on equity graph shown above. This is exactly the type of business that provides the sustainability of a Dividend Aristocrat.

Valuation:

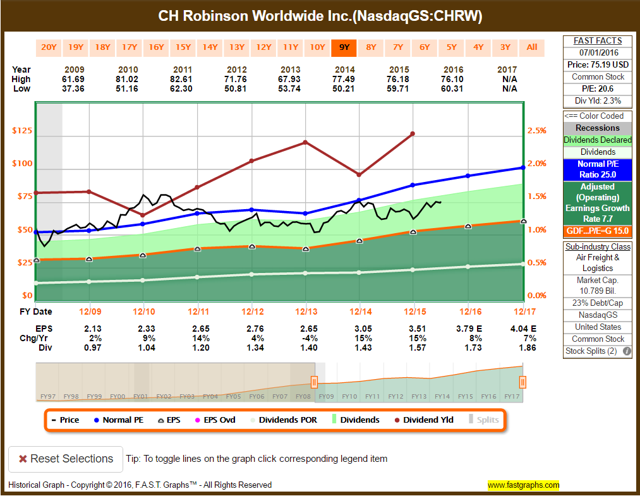

CHRW is trading at a trailing P/E of 20.8 and a forward of 18.6, below their 5 and 10 year averages of 21.6 and 25.8, respectively. I have attached a graph showing their relative valuation from FAST Graphs:

Notice that they were in overvalued territory for some time in early 2010, and have yet to retest those highs. That shows the importance of buying companies only when they are trading at or below fair value. Their earnings growth rate doesn't support a P/E ratio in the 30s like some growth stocks in the market (notice the orange earnings line slope). However, I believe that their current valuation at a forward P/E of 18.6 represents an attractive entry point.

Margin contraction hit the company hard in 2013. A drop from 5.23% to 3.26% in net margin caused them to have an earnings drop even with hitting record highs at the time in revenue. Up until this point, the management goal was for 15% revenue and EPS growth per year, which is what caused them to trade near the 30's in P/E. As stated above, though, they are trading now at about 21x trailing earnings since their growth rate is only expected to be around 8%. My take on this is that they have managed to improve their margins every year since then, which makes it seem like it was cyclical in their business. They maintained profitability, their dividend, and watched earnings drop 27%. This definitely put a dent in their growth story, but they have maintained and grown their market share (revenues have increased every year since 2009). I believe that investors should definitely watch margins going forward, but that their demonstrated and continued growth in revenues combined with margins trending upwards shows that a lower earnings growth rate going forward is possible. Maybe they don't deserve a 30x multiple, but I think they should be trading at least around the S&P 500 of ~24X, with their commitment to shareholders over time and relative safety.

Growth Prospects Going Forward:

Looking forward, CHRW is growing its LTL segment at a high rate. Q1 2016showed volume increase of 10% YOY, and that is from organic growth following integration of the 2015 FreightQuote acquisition. The LTL segment consists of less-than-truckload shipments. Expect this growth to continue at a 5-10% rate, as FreightQuote allows for greater quoting efficiencies in small load shipments.

Look for CHRW to pursue more bolt on acquisitions. The 3rd party logistics industry is highly fragmented, and management has stated that they are looking at acquiring companies that will fit into their system well, for the right price. I would like to see them take some market share in this industry, which is projected to grow to $925B by 2020, according to Global Trade Magazine. Keeping their debt levels low will help facilitate this.

Finally, CHRW has a global footprint already:

Source: CHRW Investor Presentation

They have plans to open new offices in Europe and Asia and to leverage existing partnerships to grow globally. Due to their existing footprint and infrastructure, organic growth in international markets should continue to drive returns into the future.

Conclusion:

C.H. Robinson Worldwide is a well-run company with a stable business that continues to return capital to shareholders. Their low debt and cash generation capabilities should allow them to continue increasing their dividend and become one of the dividend aristocrats. They are trading around fair value at this time, and I believe this represents a good opportunity for investment. If you liked this article, and would like to read more like it, please click the follow button next to my picture at the top of the page.

No comments:

Post a Comment