Revenue declines at Top 25 US LTL, truckload carriers

JOC Staff | Mar 11, 2016 11:25AM EST

Revenue at the largest U.S. trucking companies declined overall in 2015, with only three of 50 companies surveyed by SJ Consulting Group increasing revenue by double digits. That compares with 16 companies that expanded their top lines by double-digit percentages in 2014, the best year of the recovery for the carriers in the two survey groups.

The combined revenue of the Top 25 LTL Carriers dropped 0.5 percent last year to $32.1 billion, after shooting up 9.1 percent in 2014, while the Top 25 Truckload Carriers saw combined revenue decline 2.3 percent to $27.2 billion, after their top line rose 8 percent the previous year.

The hard brake for the biggest U.S. trucking companies reflected a broad industrial slowdown, high inventories and lower consumer demand, but also dramatically lower fuel surcharges. Falling fuel prices helped carrier profitability, but reduced surcharges often flattened revenue gains.

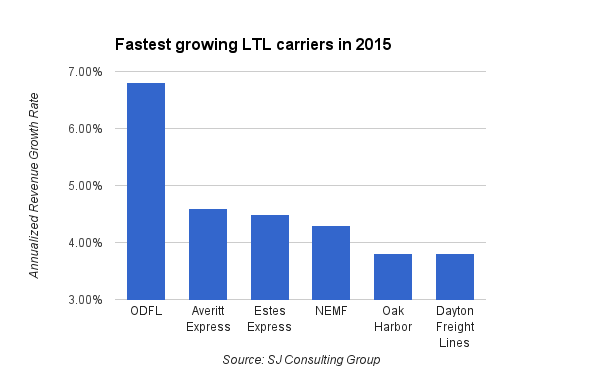

Old Dominion Freight Line, the fourth-largest LTL carrier, was the fastest growing company in its peer group, increasing annual revenue 6.8 percent to nearly $3 billion as it increased market share. Altogether, 13 LTL carriers increased revenue between 0.8 and 6.8 percent.

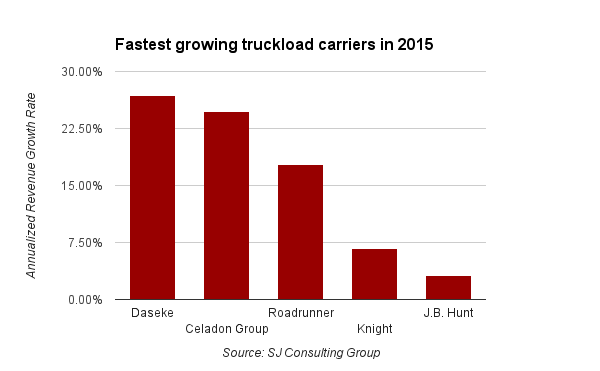

Daseke, a specialized carrier, was the fastest growing truckload operator, thanks to numerous acquisitions in 2014 and 2015, including Bulldog Hiway Express and Hornady Transportation. Daseke’s revenue leaped 26.9 percent in 2015 to $675 million, SJ Consulting said. Celadon Group and Roadrunner Transportation Systems also expanded rapidly through acquisition.

The Top 25 LTL and Truckload Carrier rankings, two of several trucking and logistics industry rankings prepared annually for JOC.com by SJ Consulting Group, will be published on JOC.com and as part of a special report in the March 21 edition of The Journal of Commerce.

No comments:

Post a Comment