Why the Biggest Big-Box Stores Survive

Sixty years after gigantic stores entered the American retail landscape, many are closing and filing for bankruptcy. But warehouse stores and club stores are doing something right.

The sheer size of big-box stores overwhelmed and impressed. Americans embraced them for the next 40 years, driving to these hulking outposts of consumerism to buy all kinds of things.

In recent years, the retail winds have changed. Just last week, Sports Authority announced that it would be liquidating merchandise and may consider closing all of its 450 stores. Before that, Best Buy was downsizing, big office-supply retailerswere consolidating, and, earlier this year, even Walmart announced that it wouldclose 154 of its U.S. stores.

Nevertheless, amid all these store closings and bankruptcies, some big-box stores are still enjoying a surprising, decades-long upward trend: warehouse stores and supercenters.

In an NBER working paper last year, Ali Hortaçsu and Chad Syverson, two economics professors at The University of Chicago’s Booth School of Business, looked at the major changes in the U.S. retail sector in the past 20 years. They found that, contrary to conventional wisdom, the rise of online retailers hadn’t brought about the demise of brick-and-mortar shopping. As a point of comparison, the study found that between 2000 and 2013, Costco’s sales grew by $50 billion while Amazon added $38 billion.

“What we found is that a certain kind of big-box stores, that is supercenters and warehouse stores, they've been doing great and they're still doing great. That's your Walmart supercenters, that's your Meijer, Costco, Sam's Club,” explains Syverson. “If you get to specific other stores that sell specific goods, like sporting goods, office equipment, then it's a mixed bag.”

According to Syverson’s research, sales at warehouse stores and supercenters grew 10 times from $40 billion to $420 billion from 1992 to 2013. But over the same period, sales and employment at department stores shrunk. A recent studyby real-estate firm Green Street Advisors found that Sears and JC Penney would both need to close 300 stores in order to get back to its sales-per-square-foot levels 10 years ago.

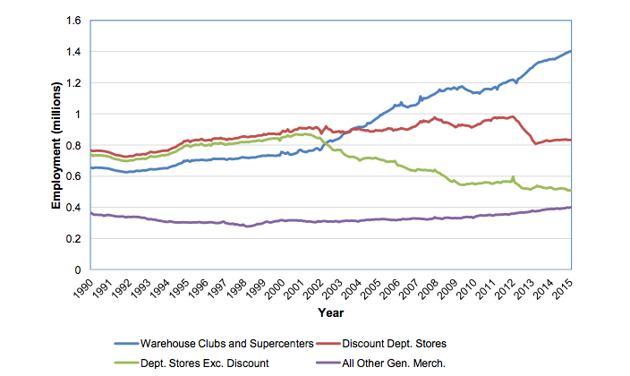

Retail Employment by Store Type, 1990-2015

The question of why e-commerce has cut into the sales of certain kinds of stores and not others likely has to do with convenience. There will always be consumers that never buy items online and there will always be items that consumers want to buy in person. Among the latter appears to be food.

“One of the commonalities in the stores that are succeeding is some sort of emphasis on food,” says Paul Ellickson, a professor of marketing and economics at the University of Rochester’s Simon School of Business who studies the history of supermarkets. “Club stores, supercenters, and big-box grocery stores all involve some element on food which is perishable and really has not had much success being delivered online.”

Beyond food, Ellickson adds that the perks of convenience and variety offered by online shopping tend to lose value when it comes to items that consumers may want to inspect personally, may be uncomfortable buying online, or may be difficult to return.

As for the future of retail, while Syverson says he doesn’t foresee the demise of physical or big-box stores, he expects that, unlike during the 1980s or 1990s, big-box stores won’t be getting any bigger. “I think it's still going to be a physical establishment,” says Syverson. “Until e-commerce really makes inroads into drugs, cosmetics, food and beverage, there's a huge amount of retail volume out there that basically e-commerce hasn't touched yet at all. So it's still going to be a physical store but what size it is, it's harder to say.

No comments:

Post a Comment