The benefits of supply chain speed

April 11, 2017 by Marty Lariviere

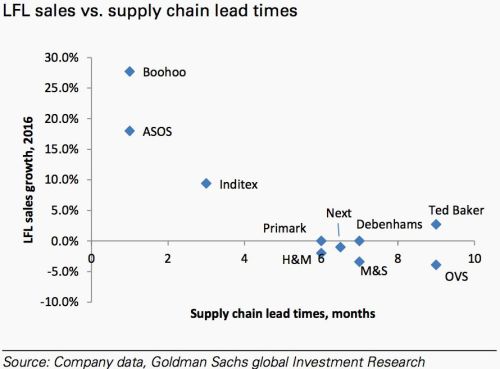

Here is an interesting graph. It comes from Goldman Sachs by way of Quartz (A new generation of even faster fashion is leaving H&M and Zara in the dust, Apr 6).

It is showing that how sales growth relates to lead time. And while I am obliged to say that correlation is not causation, it seems pretty clear that it is good to be fast; firms with shorter lead times have distinctly higher sales growth.

The focus of the Quartz article is on Boohoo and Asos, two British web-based apparel retailers that target young shoppers. As seen in the chart, their recent performance has been smoking everyone — even Inditex, the parent of Zara. An obvious consideration here is that both Boohoo and Asos are younger, smaller firms so it is easier for them to generate rapid growth than older, larger firms. It also seems that at least Asos has done some things recently to juice its sales that are independent of its operational expertise. For example, the Financial Times reports that they took advantage of a week British pound following the Brexit vote to cut price in international markets (Asos cuts its cloth for growth but leaves less margin for error, Apr 4).

But it is still an interesting question of how a web-based retailer can benefit from its distribution structure to execute fast fashion faster.

Looking at Boohoo is possibly instructive here. A post on Fashionista offers some information on how they run things (How Boohoo.com Releases up to 300 New Products a Day, Dec 16, 2015). As the title of the post suggests, Boohoo is rolling out lots and lots of new styles. They offered 4,000 new products in October, 2015. Focus on business days, and that gets you an average of 200 items a day (although some days top 300 items). Boohoo claims that it can go from identifying a trend to having items on its site in under two weeks, which lends itself to a lot of testing to see how customers react.

Boohoo also has the luxury of local production facilities in the U.K., where the company says it produces about 50 percent of its products. Plus, Kamani and Kane’s many years in the biz have allowed the company to develop relationships with even its most distant international factories, where it can place shallow orders on new items. This is the backbone of Boohoo’s “test-and-repeat” business model: It will stock only a few of a new style or trend, and then buy deeper if it performs well. “We can buy anything from 200-600 of a style and [do] a crowdsourcing approach where the customer ranks the stock for us,” explains Kane. “Within 48 hours of something going live, we have a good idea as to how many weeks we should run that style for and what kind of depth we should buy into it.” This business is also facilitated by the fact that Boohoo is online-only, and doesn’t have to worry about stocking multiple points of sale.This ability to experiment system-wide seems to be where Boohoo’s speed really pays off. A short production run of a few hundred unit might allow Zara to experiment in a handful of stores. That may give them enough confidence to invest in a product across all of their markets but they are unlikely to have anywhere near the certainty that Boohoo would have. Once they do learn, Boohoo would also have an even easier time to get additional supplies to where they are needed. They just need to stock up their distribution centers while Zara has to fill out all its stores.

No comments:

Post a Comment